The credit volume is higher than in 2019

17 September 2020 - 7 min Reading time

Despite fewer new loan applications, credit volumes remained higher in the second quarter of 2020 compared to 2019. This means that the financial sector is more committed than ever to supporting the real economy.

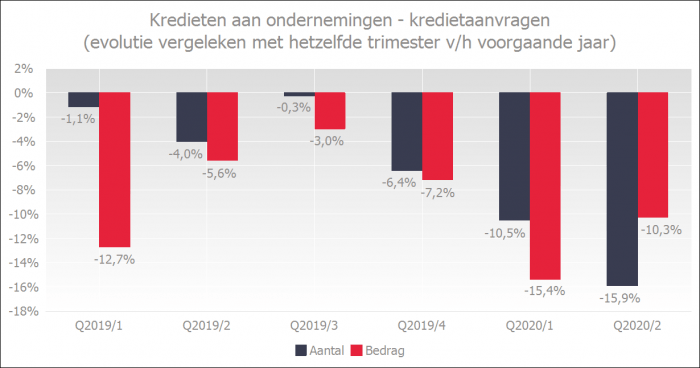

The COVID-19 crisis has significantly impacted business confidence. Due to the economically uncertain period, businesses are investing less. The data shows that in the second quarter of 2020, significantly fewer business loans were requested compared to the same period in 2019, with the requested amount decreasing by 10.3% compared to the previous year.

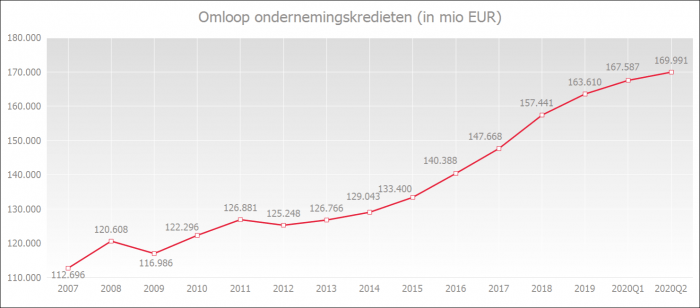

Since demand and supply are interrelated, this decline was also reflected in the production of new loans. The amount of newly granted loans decreased by 14%. According to preliminary figures from the National Bank of Belgium (NBB), economic activity (GDP) decreased by 2.4% in both the first and second quarters of 2020. Despite this declining production, the outstanding volume of business loans in mid-2020 was still 4.5% higher than a year earlier, reaching 170.0 billion euros.

However, the high loan volume and the willingness to grant payment deferrals show that the financial sector continues to support the economy even in these difficult times. The banks' willingness to provide loans remains high, as reflected in the low loan rejection rate, despite the challenging economic context.

Entrepreneurs are requesting less new credit

It's clear that the COVID-19 crisis has had an impact on business confidence. Due to the economically uncertain period, businesses are investing less, resulting in a decrease in demand for new business loans.

In the second quarter of 2020, entrepreneurs requested 15.9% fewer loans than in the same period the previous year. This marks the sixth consecutive decline. However, the decrease in the loan amount requested was less significant, at 10.3%.

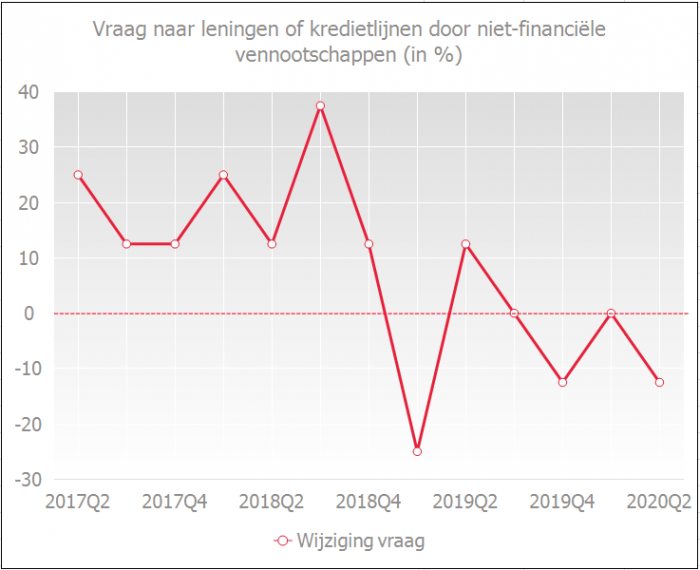

In the Bank Lending Survey (BLS) conducted by the NBB, banks also reported reduced demand for loans in the second quarter of 2020. There was particularly less demand for loans to finance fixed investments, mergers and acquisitions, and debt restructuring.

A positive percentage in the chart above corresponds to an increase in loan demand, while a negative percentage corresponds to a decrease. A zero percentage indicates stabilization.

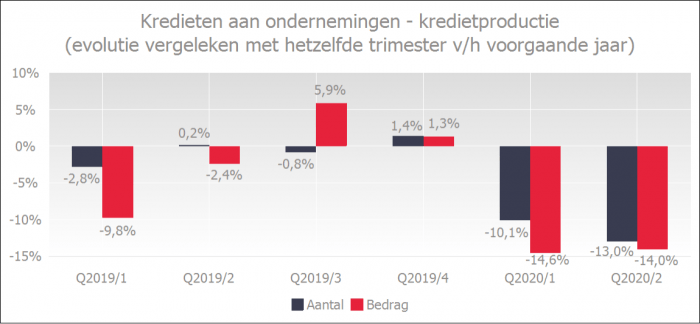

Decline in GDP & reduced loan demand have had a negative impact on credit production

According to the National Bank of Belgium (NBB), economic growth decreased by 2.4% and 14.4% in the first and second quarters of 2020, respectively (preliminary figures). The restrictive COVID-19 measures have affected economic activity, resulting in a decrease in both loan demand and credit production.

The National Bank of Belgium estimates a -9.0% annual GDP change in 2020 and expects a slight recovery of +6.4% and +2.3% in 2021 and 2022, respectively.

The number of granted loans in the second quarter of 2020 decreased by 13.0% compared to the same quarter the previous year, with granted amounts 14.0% lower than in the same period of the previous year.

Outstanding business loan volumes remained high

Outstanding business loan volumes remained high, reaching 170.0 billion euros in June 2020, including commitment lines such as guarantee loans and documentary credits.

On a year-on-year basis (comparing June 2019 with June 2020), the outstanding amount increased by 4.5%. In March 2020, the year-on-year growth rate was 5.1%.

Several factors explain why the outstanding loan volume can increase even when credit production declines.

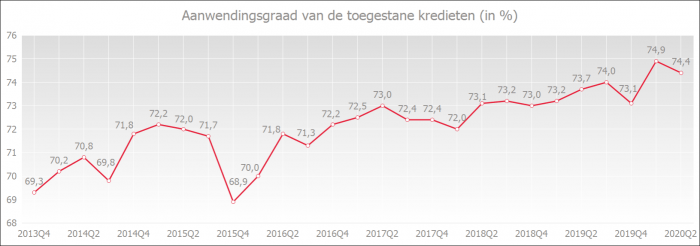

- Compared to previous quarters and years, the utilization rate of authorized loans to non-financial corporations is at its second-highest level. In other words, businesses have been making more use of existing credit lines in recent months, reducing their need for new credit production

- It is statistically logical that the base effect observed in credit production only has a tempered impact on the entire credit cycle (previously granted loans have a buffering effect on the total cycle).

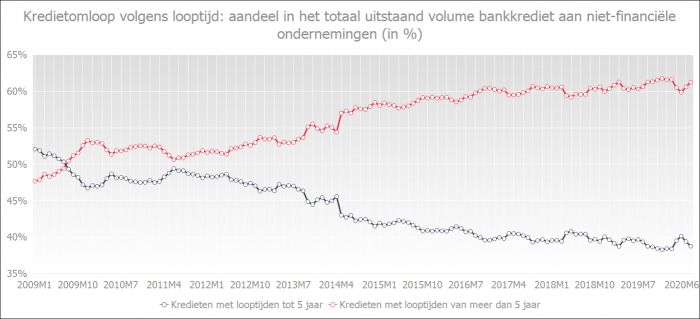

- The chart below shows that the share of long-term loans to non-financial companies in the total loan volume is increasing. With a greater emphasis on long-term loans, there is less turnover in the loan volume, which can lead to an increase in the total loan volume even when credit production is more moderate or declining.

The high loan volume and the willingness to grant payment deferrals demonstrate that the financial sector continues to support the economy, even in these challenging times. The banks' willingness to provide loans remains high, as evidenced by the low loan rejection rate.

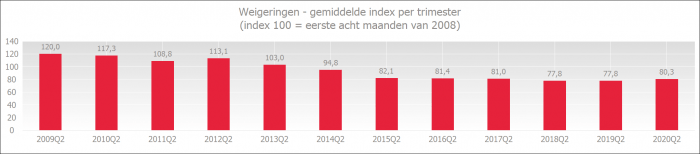

Entrepreneurs still perceive few credit constraints

The rejection rate in the second quarter of 2020 remains low compared to all second quarters, despite the challenging economic context in which we find ourselves.

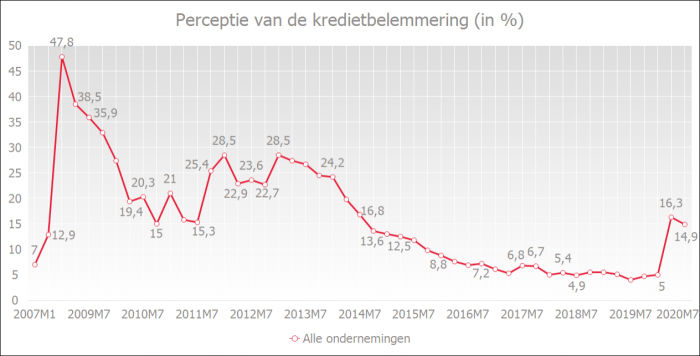

The quarterly survey by the National Bank of Belgium (NBB) shows that the perception of credit constraints by businesses in July 2020 was at 14.9%. The percentage increased from 5.0% in January to 16.3% in April, then decreased to 14.9% in July. This perception of credit constraints is still considerably lower than during the banking crisis of 2008-2009 when it peaked at nearly 50%.

However, it is important to note that the increase in perceived credit constraints by entrepreneurs does not necessarily mean that more loans are being rejected (as indicated by the low rejection rate).

Rather, it is more about how businesses perceive credit conditions, particularly interest rates, bank fees, loan volumes, and required collateral.

A decrease in the graph below reflects the perception of credit constraints. The lower the curve, the fewer credit constraints entrepreneurs believe they are facing.

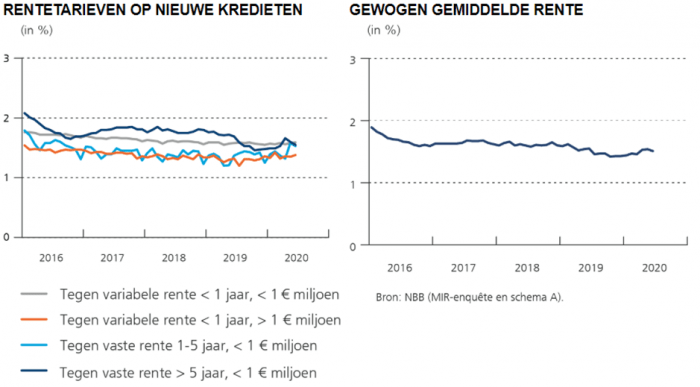

Interest rates remain favorable for business borrowers

The weighted average interest rate on new corporate loans remained low. According to NBB data, the weighted average interest rate on new corporate loans decreased slightly to 1.51% in June 2020 (compared to 1.54% in May 2020).