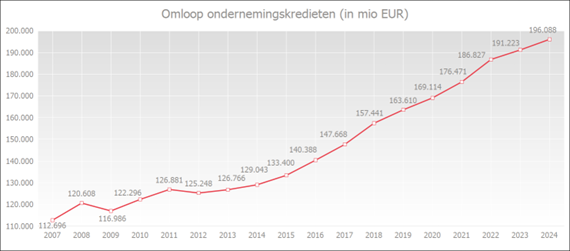

Outstanding amount of business loans at a record high

6 min Reading time

The outstanding volume of business loans at the end of December 2024 was 2.5% higher than a year earlier, reaching €196.1 billion.

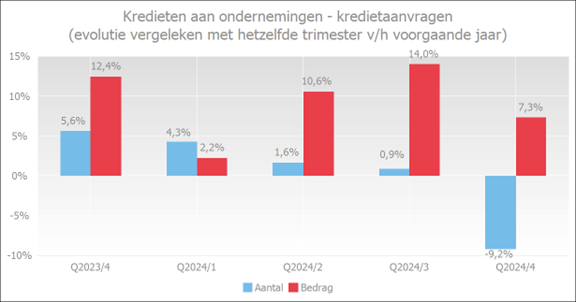

In the fourth quarter of 2024, there were 9.2% fewer business loans requested than in the same period of 2023. The total amount of these requested credits did increase by 7.3%.

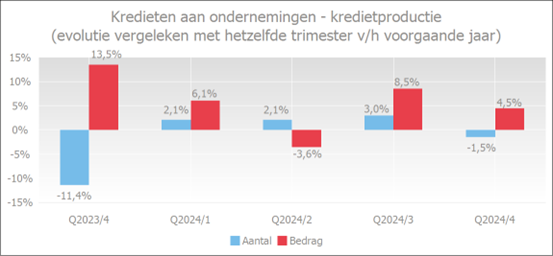

The number of credits granted also decreased. In the fourth quarter of 2024, 1.5% fewer credits were granted than in the same quarter of last year. However, the amounts granted were also 4.5% higher.

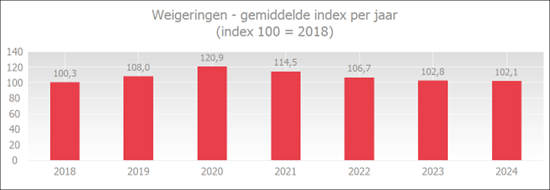

The refusal rate was again lower in 2024 than in 2023. It has been since 2018 that the refusal rate was so low.

Outstanding amount of business loans at a high level

At the end of December 2024, the outstanding amount of drawn business loans, including commitment loans , stood at €196.1 billion, which was 2.5% higher than a year earlier.

Source: Febelfin

Credit demand and production increase in amount

In the fourth quarter of 2024, entrepreneurs applied for 9.2% fewer credits than in the same period last year, but for a higher amount. The applied amount in fact increased by 7.3%.

Source: Febelfin

The number of loans granted also decreased in the fourth quarter of 2024 compared to the same quarter last year, by 1.5%. The amounts granted were 4.5% higher than in the same quarter last year.

Source: Febelfin

The increase in amount (versus the decline in number) is due to a limited number of syndicated loans of several hundred million euros, to which the main Belgian banks contributed.

Entrepreneurs experience fewer credit barriers

The rejection rate was slightly lower in 2024 than in 2023.

Source: Febelfin

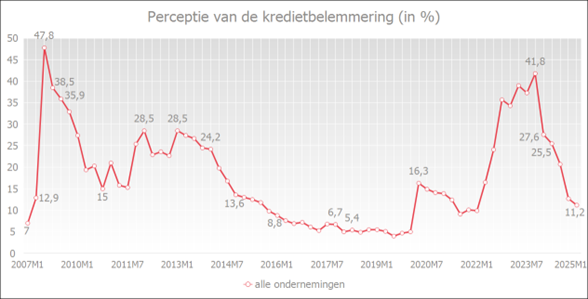

Results from the National Bank of Belgium's (NBB) quarterly survey on the perception of credit constraints among firms also indicate that banks would have eased their credit conditions slightly. The share of firms that perceived credit conditions as unfavourable stood at 11.2% in January 2025, down from 12.7% in October 2024.

Perceptions had started to rise sharply at the end of 2021, largely linked to the rise in interest rates. From the end of 2023, interest rates started to ease slightly and this was reflected in the perception of the credit constraint.

The chart below shows the evolution of credit perceptions. A decrease indicates a perceived easing of credit conditions. An increase, on the contrary, indicates that companies believe it is less advantageous to obtain credit.

Source: NBB

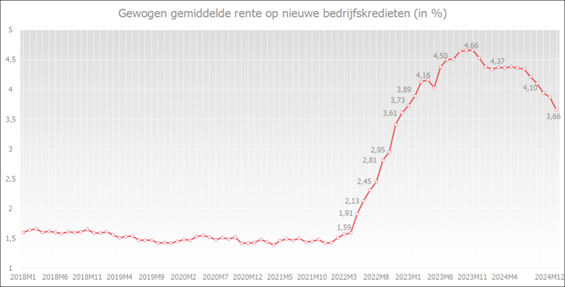

Interest rates have fallen further

The weighted average interest rate on new business loans had peaked at 4.66% in November 2023. By December 2024, that interest rate had already fallen to 3.66%.

Source: NBB