Number of consumer loans granted on the rise again

16 February 2023 - 3 min Reading time

Especially energy-saving loans are surging

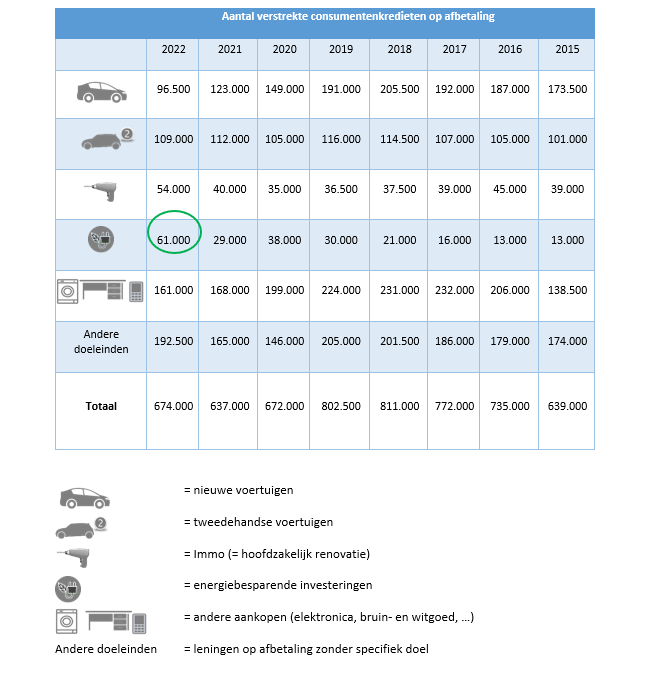

The number of consumer loans granted by BVK members in Belgium increased again in 2022 after a decline in 2021. In total, 674,000 loans were granted in 2022, with an increase of more than 110% in the number of energy-saving loans granted.

In 2022, BVK members, representing 95% of the market, concluded about 674,000 new installment credit agreements for a total amount of nearly 9 billion EUR. This is an increase of almost 6% compared to 2021 in the total number of credit agreements granted. Despite this increase, the number is still about 16% below the level of 2019.

Consumer loans play a crucial role in the green transition

The largest increase is observed in the category of energy-saving loans. A total of 61,000 such loans were granted for a total amount of nearly 1 billion EUR. This is an increase of 110% compared to the previous year. The number of renovation loans also sees a strong increase of more than 35%.

"More and more consumer loans are going to projects that contribute to the green energy transition," says Bart Vervenne, Chairman of the Board of Directors of BVK. "The energy crisis of the past year has made Belgians very aware of the energy performance of their homes. Consumer loans ensure that sustainable investments can be made and that our society will be able to make the green transition"

In contrast to last year, the number of loans for the purchase of new vehicles has decreased significantly, by 21.5%. The number of loans for used cars also saw a slight decline, by just under 3% compared to 2021. This decline can be partly explained by ongoing shortages of parts and long delivery times, uncertainty about the transition to electric driving, but also by changing habits of Belgians, such as more remote work.

VAB (Flemish Motorists' Association), Mobility Barometer.

On the other hand, the market share of environmentally friendly cars is growing, and new cars are inherently more environmentally friendly as they replace older, less environmentally friendly ones.

For loans for other purchases, such as household appliances, electronics, and furniture, there is a slight decrease of about 4%.