More new business loans, fewer credit constraints

6 June 2024 - 6 min Reading time

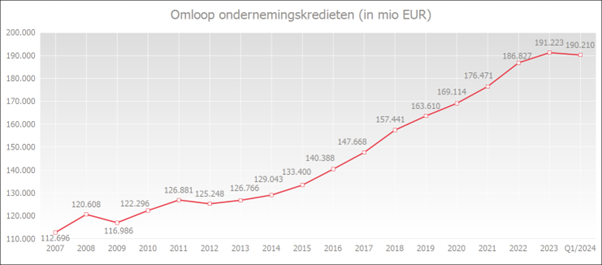

The outstanding volume of business loans at the end of March 2024 was 1.6% higher than a year earlier, reaching €190.2 billion.

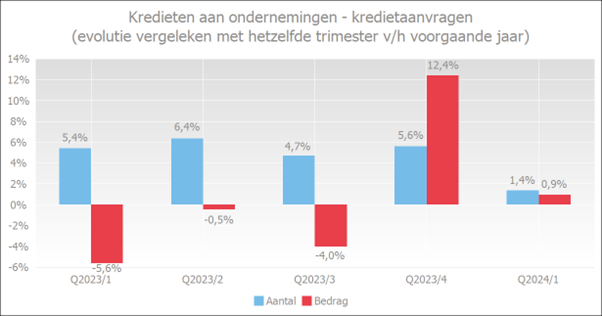

In the first quarter of 2024, there were 1.4% more business loans applied for than in the same period of 2023, the total amount of these loans applied for increased quite moderately by 0.9%.

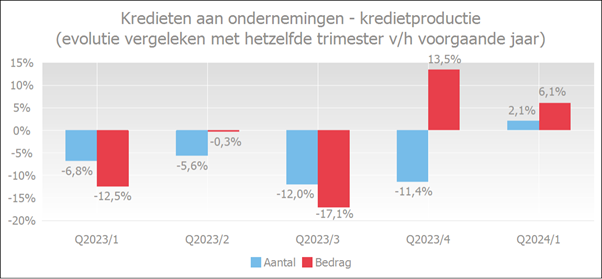

Both the number and amount of credits granted increased. In the first quarter of 2024, 2.1% more credits were granted than in the same quarter last year. The amounts granted were 6.1% higher.

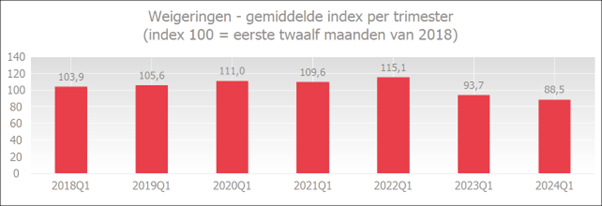

The refusal rate in the first quarter of 2024 was at the lowest level of any first quarter since 2018.

Outstanding amount of business loans remains at a high level

At the end of March 2024, the outstanding amount of borrowed business loans, including commitment loans (such as guarantee loans and documentary loans), stood at €190.2 billion, which was 1.6% higher than a year earlier.

Source: Febelfin

Credit demand and production increase in number and amount

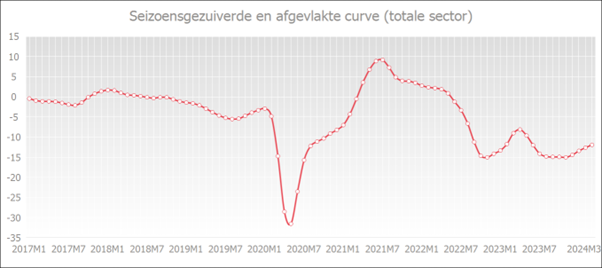

Business confidence has gradually started to recover since December 2023. The curve below reflects the underlying business trend. For instance, an increase in the curve reflects the reinforcement of business confidence.

Source: NBB

This gradual recovery is also reflected in credit demand. In the first quarter of 2024, entrepreneurs applied for 1.4% more credit than in the same period last year. In amount, however, the increase was still very limited (+0.9%).

Source: Febelfin

Credit production experienced a stronger increase. The number of loans granted rose by 2.1% in the first quarter of 2024 compared to the same quarter last year. The amounts granted were 6.1% higher.

Source: Febelfin

Entrepreneurs encounter fewer credit obstacles

The refusal rate in the first quarter of 2024 was at the lowest level of any first quarter since 2018.

Source: Febelfin

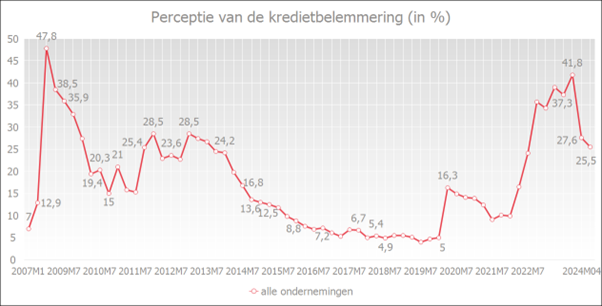

Results of the National Bank of Belgium's (NBB) quarterly survey on the perception of credit constraints among enterprises also indicate that banks would have eased their credit conditions slightly. The share of enterprises that perceived credit conditions as unfavourable stood at 25.5% in April 2024, down from 27.6% in January 2024.

Perceptions had started rising sharply in late 2021, which was largely attributable to the rise in interest rates. From the end of 2023, interest rates started to lower a little and this was reflected in the perception of the credit constraint.

The chart below shows the evolution of credit perceptions. A decrease indicates a perceived easing of credit conditions. An increase, on the other hand, indicates that companies believe it is less advantageous to obtain credit.

Source: NBB

Interest rates have declined slightly

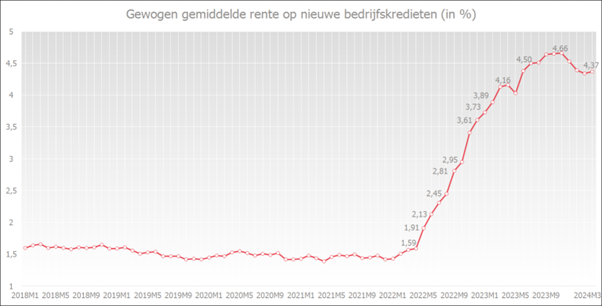

The weighted average interest rate on new business loans seems to have peaked at 4.66% in November 2023. In March 2024, that interest rate was still at 4.37%.

Source: NBB