Lending to entrepreneurs continues to reach new height

4 October 2019 - 6 min Reading time

Credit lending to businesses credit circulation hits €162.6 billion. Demand and number of new loans decrease slightly

At the end of June 2019, Belgian banks had a new record in business loans: €162.6 billion.

However, this new peak is not reflected in the number of loan applications. On the contrary, in the second quarter of 2019, businesses requested fewer loans than in the same period in 2018. This declining demand is related to decreased business confidence, as revealed by the National Bank of Belgium's business survey.

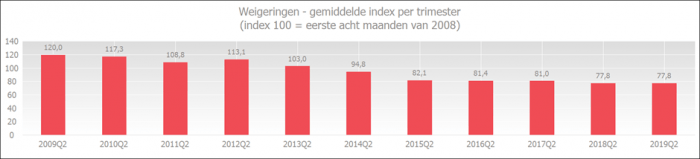

Due to the decreased demand, banks granted fewer new loans. Nevertheless, businesses clearly indicated that they are not experiencing more credit obstacles when applying for loans. The rejection rate in the second quarter of 2019 is at the same level as in the second quarter of 2018. Compared to all second quarters, it is the lowest level since measurements began in 2009.

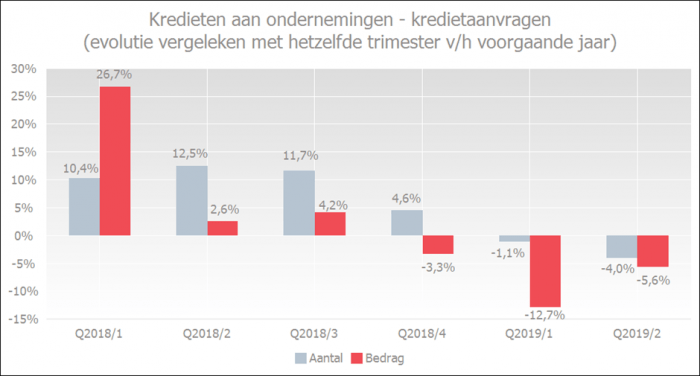

Entrepreneurs request fewer loans; uncertainties weigh on business confidence

In the second quarter of 2019, entrepreneurs requested 4.0% fewer loans than in the same period the previous year. In terms of amount, there was a 5.6% decrease.

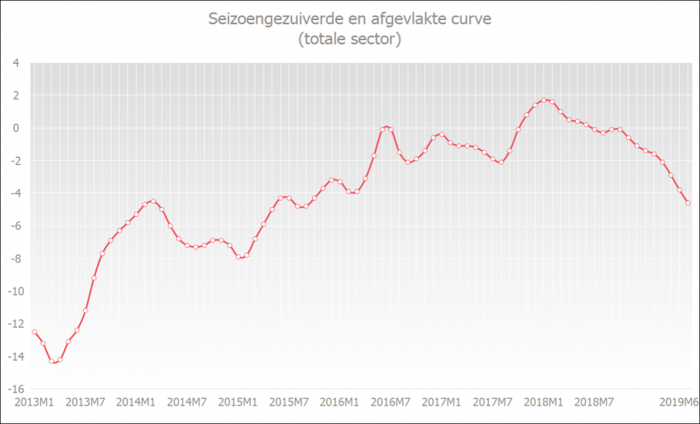

According to the National Bank of Belgium's business survey, business confidence continued to decline in June 2019. The reason? Numerous uncertainties: trade conflicts, fears of a hard Brexit, the political situation in Belgium, and more.

The seasonally adjusted and smoothed curve reflects the underlying business confidence trend.

The decline in this curve indicates a weakening of business confidence.

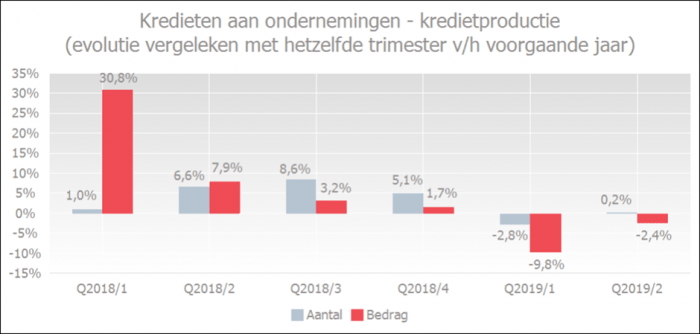

Number of new Loans stabilizes; total number of loans increases less strong

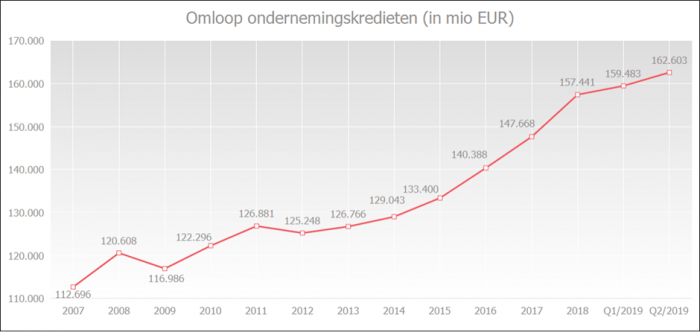

The outstanding volume of business loans increased by 4% between mid-2018 and mid-2019, reaching a new record of €162.6 billion at the end of June 2019.

Credit production However, the number of newly granted loans in the second quarter of 2019 stabilized compared to the same period the previous year. The amount decreased by 2.4%.

The reduced credit production in the second quarter of 2019 is associated with an increase in the total outstanding credit circulation (although it is also losing strength). Why does this correlation exist?

- Statistically, it makes sense that the basic effect observed in credit production has only a tempered effect on the entire credit circulation. The loans previously granted have a buffering effect on the total circulation.

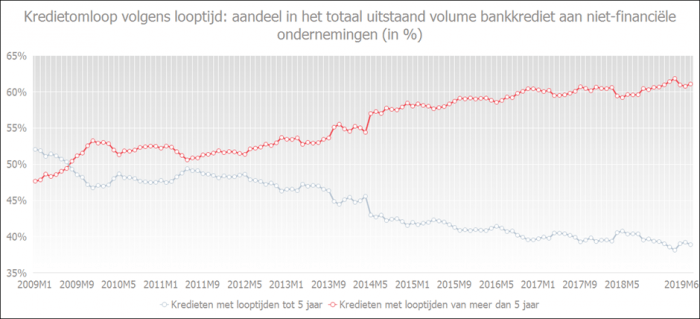

- The chart below shows that long-term loans to non-financial companies have an increasingly larger share in the total. This results in less "rotation" in the credit volume, and the total credit circulation can still increase when credit production experiences more moderate growth.

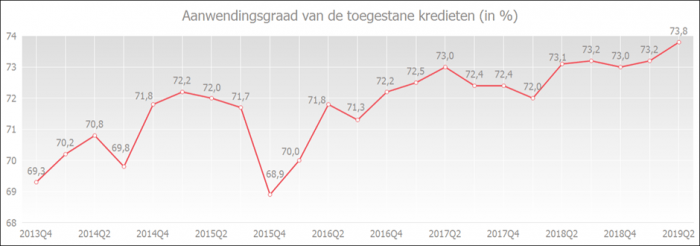

- The utilization rate of granted loans to non-financial corporations was very high in mid-2019. In other words, in the second quarter of 2019, businesses made intensive use of their existing credit lines.

Businesses experience few obstacles in loan application

The rejection rate in the second quarter of 2019 remained at the same level as in the second quarter of 2018. Compared to all second quarters, it is the lowest level since 2009.

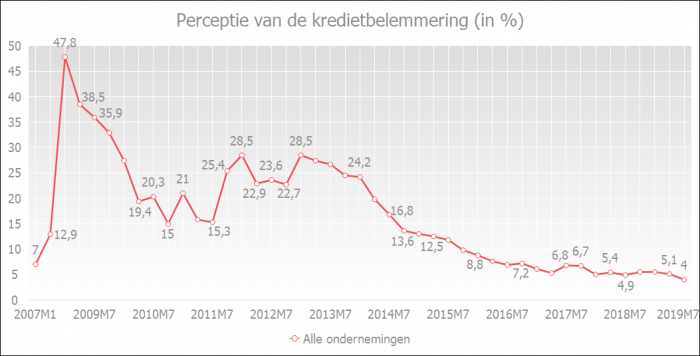

Belgian companies also reported in the National Bank of Belgium's periodic survey that they perceive fewer credit obstacles. The perception of credit obstacles is historically low. In April 2019, 5.1% of companies still considered credit conditions unfavorable. In July 2019, this had decreased to 4.0%.

A decrease in the chart below reflects the gradual improvement in the perception of credit obstacles. The lower the curve, the fewer credit obstacles entrepreneurs believe they are experiencing.

Due to the ECB's accommodative monetary policy, there is a significant amount of liquidity in the market, allowing banks to grant loans fairly easily.

Businesses borrow at favorable rates

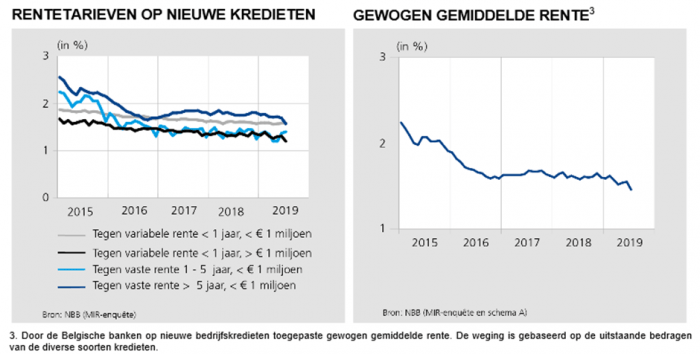

The ECB's accommodating monetary policy is also reflected in the interest rates for business loans.

According to data from the National Bank of Belgium, the weighted average interest rate on new business loans reached a new low of 1.46% in July 2019.

What Is the Febelfin credit barometer?

The Febelfin barometer reflects the evolution of loan applications, credit production or newly granted loans, the total outstanding volume of loans, and the rejection rate. The barometer is compiled every three months and covers almost the entire market.