Individuals and businesses granted more than 260,000 payment deferrals

26 June 2020 - 4 min Reading time

Febelfin Corona Monitor: The Latest Developments in Perspective

- Belgian banks continue to support families and businesses, especially during the coronavirus crisis. In recent weeks, they have provided:

- 133,439 payment deferrals for business loans

- 4,342 payment deferrals for consumer loans

- 122,393 payment deferrals for mortgage loans

- Anyone facing financial difficulties due to the coronavirus crisis and wishing to request a payment deferral is asked to contact their bank as soon as possible. The various contact points at the banks are listed here.

- Belgians have adopted more digital payment habits during the coronavirus crisis and seem to be maintaining them.

- Now that many COVID-19 measures have been significantly relaxed, and most retailers and points of sale have reopened, Febelfin encourages people to continue paying digitally (using cards and smartphones) as much as possible. Digital, especially contactless, payments are the most hygienic and secure way to pay.

Families and businesses can rely on banking support

Banks continue to fully support consumers, businesses, and self-employed individuals facing financial pressure due to the coronavirus crisis.

Since March 31, 2020, they have granted 122,393 payment deferrals to individuals for their mortgage loans. The total underlying loan volume amounts to 12.9 billion euros, or an average of 105,137 euros per loan.

Since May 20, individuals can also request payment deferrals for their consumer loans. Such deferrals have been granted 4,342 times for an underlying loan volume of 86.9 million euros.

As for businesses, banks have granted payment deferrals for business loans 133,439 times since March 31. The total underlying loan volume is 22.5 billion euros, or an average of 168,802 euros per loan. More than 80% of the number of payment deferrals are granted to SMEs and self-employed individuals.

Anyone experiencing financial difficulties due to the coronavirus crisis and wishing to request a payment deferral is asked to contact their bank as soon as possible. The various contact points at the banks can be found through this link.

Belgians adopt more digital payments

Since the outbreak of the coronavirus crisis, retailers and banks have been encouraging people to pay digitally as much as possible. Paying with cards and smartphones is an extremely safe and hygienic way to make purchases, especially when done contactlessly. Belgians have adjusted their payment behavior accordingly and seem to be maintaining this new digital habit.

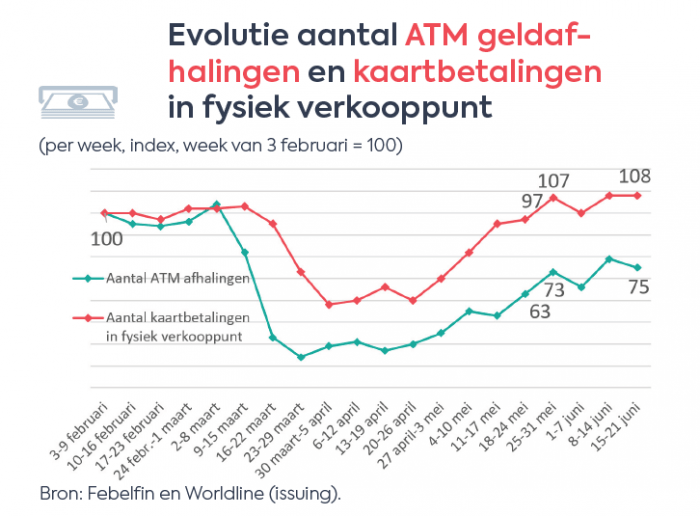

The chart below indicates that Belgians still use cards more frequently than cash for payments.

Febelfin urges everyone to continue paying digitally (using cards and smartphones) as much as possible, even now that most retailers and points of sale have reopened.

These figures are also available in the Corona Monitor.