Greater demand for business loans results in more new loans

6 min Reading time

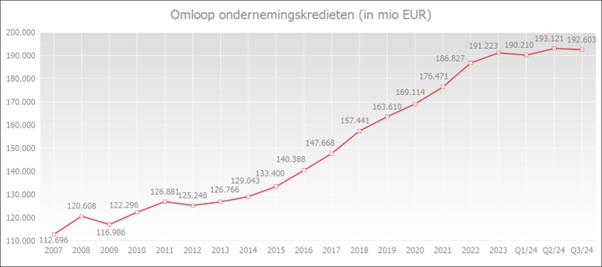

The outstanding volume of business loans at the end of September 2024 was 2.0% higher than a year earlier and amounted to EUR 192.6 billion.

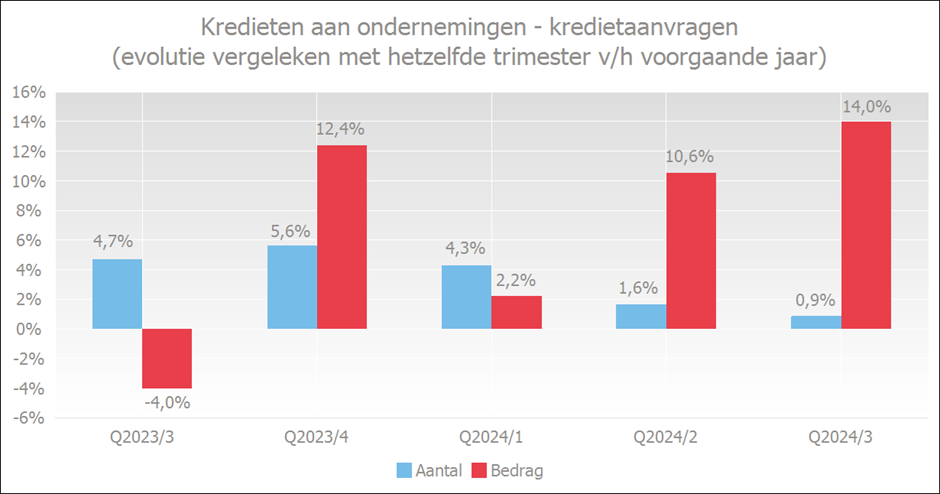

In the third quarter of 2024, 0.9% more business loans were applied for than in the same period of 2023, and the total amount of these loans applied for actually increased by 14.0%.

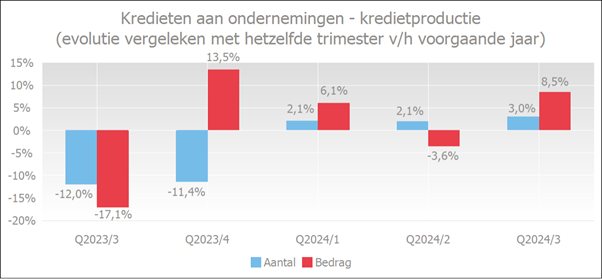

The number of loans granted also increased. In the third quarter of 2024, 3.0% more credits were granted than in the same quarter last year.

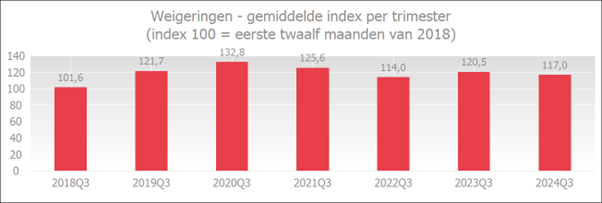

The amounts granted were 8.5% higher. The refusal rate in the third quarter of 2024 was at the third lowest level of all third quarters since 2018.

Outstanding amount of business loans remains at a high level

At the end of September 2024, the outstanding amount of drawn business loans, including commitment loans (such as guarantee loans or documentary credits), stood at €192.6 billion, which was 2.0% more than a year earlier.

Source: Febelfin

Credit demand and production increase in number and amount

Partly due to the interest rate cuts, there is a positive trend in both credit applications and credit production.

In the third quarter of 2024, entrepreneurs applied for 0.9% more credit than in the same period last year. The amount applied for even increased by 14.0%. The sharp increase in the amount of credit applications can partly be explained by a bank's ability to improve its capturing process/methodology in January 2024.

Source: Febelfin

The number of loans granted increased by 3.0% in the third quarter of 2024 compared to the same quarter last year. The amounts granted were 8.5% higher than in the same quarter last year. The stronger increase in the amount than in the number is related to a higher average amount.

Source: Febelfin

Entrepreneurs experience less credit constraints

Compared to all previous third quarters, the 2024 third quarter refusal rate is at its third lowest level since 2018.

Source: Febelfin

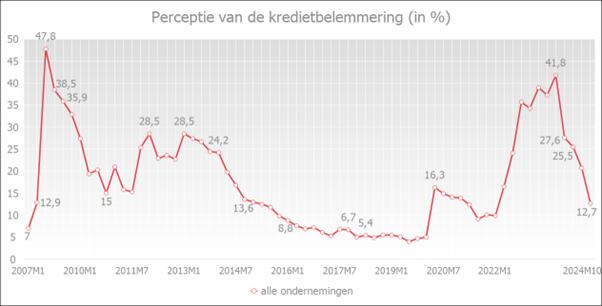

Results from the National Bank of Belgium's (NBB) quarterly survey on firms' perceptions of credit constraints also indicate that banks would have eased their credit conditions slightly. The share of firms that perceived credit conditions as unfavourable stood at 12.7% in October 2024, down from 20.7% in July 2024.

Perceptions had started to rise sharply in late 2021, largely linked to the rise in interest rates. From the end of 2023, interest rates started to move somewhat lower and this was reflected in the perception of the credit constraint.

The chart below shows the evolution of credit perceptions. A decrease indicates a perceived easing of credit conditions. An increase, in turn, indicates that firms perceive it to be more unfavourable to obtain credit.

Source: NBB

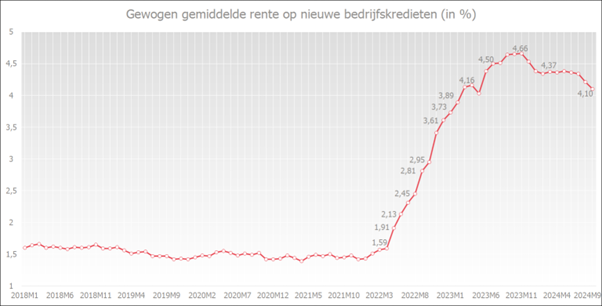

Interest rates have fallen further

The weighted average interest rate on new business loans peaked at 4.66% in November 2023. By September 2024, that interest rate had already fallen to 4.10%.

Source: NBB