Evolution of mortgage loans in April 2021

26 May 2021 - 3 min Reading time

The number of credit applications increased by 89% in April 2021 compared to April 2020. The corresponding total amount of these applications was even nearly 113% higher.

In April 2021, the number of granted loans increased by about 93%. The loan amount also increased by almost 110% compared to April 2020.

These exceptional growth figures can be explained by the fact that the figures for April 2020 were exceptionally low due to the COVID-19 pandemic and the associated lockdown. But even compared to April 2019, there was an increase in granted loans of 8% (+20% in the corresponding amount).

These findings are based on the data from the Mortgage Credit Barometer of the Professional Association of Credit (BVK).

Om de evolutie van het hypothecair krediet sneller te kunnen volgen, stelt de Beroepsvereniging van het Krediet (BVK) sinds begin 2009 een hypothecaire-kredietbarometer op. Deze barometer geeft elke maand de evolutie weer van het aantal en volume nieuw toegekende en aangevraagde hypothecaire kredieten van de voorbije maand, in vergelijking met dezelfde maand van het voorgaande jaar. De vermelde percentages hebben betrekking op omzeggens de totaliteit van de BVK-markt van hypothecaire kredieten. De onderliggende absolute cijfers worden op trimestriële basis vrijgegeven via een persbericht van Febelfin.

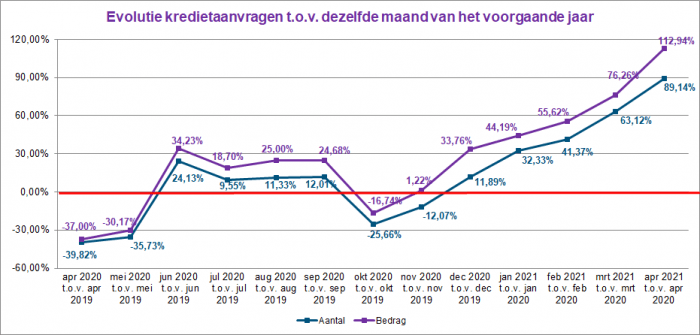

Loan Applications

The following chart shows the evolution of loan applications, in amount and number, for the past twelve months. The monthly figures are compared to those of the same month in the previous year.

In April 2021, the number of applications for a mortgage loan increased by slightly more than 89% compared to April 2020. In terms of amount, there was even an increase of nearly 113% compared to the previous year.

The increase in the number of loan applications occurred across the board: loans for the purchase of a home (+115%), for the construction of a home (+86%), and for home renovations (+77%). The number of applications for loans for purchases with renovations (+131%) as well as the number of external refinancing applications (+42%) also saw a significant increase.

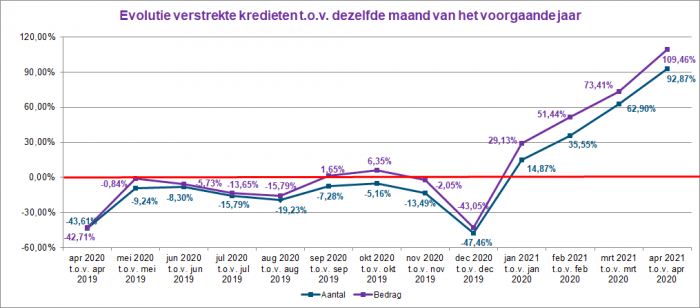

Granted Mortgage Loans

The following chart shows the evolution of granted mortgage loans, in number and amount, for the past twelve months. The monthly figures are compared to those of the same month in the previous year.

In April 2021, the number of granted mortgage loan agreements was approximately 93% higher than in April 2020. The corresponding loan amount also increased by slightly more than 109%.

The increase in the number of granted loans occurred across the board: loans for the purchase of a home (+87%), for the construction of a home (+139%), for home renovations (+84.5%), and for purchases with renovations (+70%). External refinancing loans (+120%) also saw a strong increase