Evolution of mortgage credit in August 2019

2 October 2019 - 3 min Reading time

The number of credit applications increased by nearly 11% in August 2019 compared to August 2018. The corresponding total amount of these applications was also 11.5% higher. In August 2019, the number of granted loans increased by just over 9%. In terms of amount, approximately 8% more credit was granted than in August 2018.

These figures are based on the data from the Mortgage Credit Barometer of the Professional Association of Credit (BVK).

To track the evolution of mortgage credit more quickly, the Professional Association of Credit (BVK) has been compiling a mortgage credit barometer since the beginning of 2009. This barometer provides a monthly overview of the evolution of the number and volume of newly granted and requested mortgage credits for the past month, in comparison to the same month of the previous year. The mentioned percentages pertain to nearly the entirety of the BVK market of mortgage credits. The underlying absolute figures are released on a quarterly basis through a press release by Febelfin.

Credit Applications

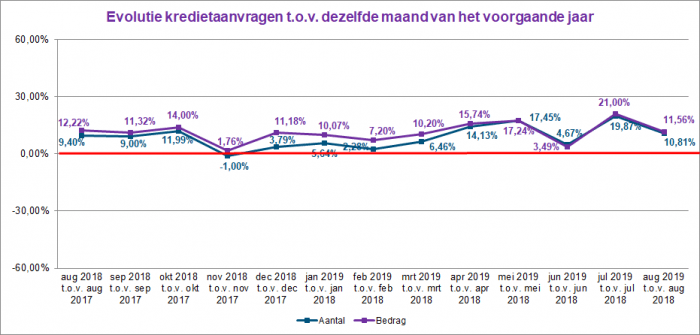

The following chart illustrates the evolution of credit applications, in terms of both the amount and the number, for the past twelve months. The monthly figures are compared to those of the same month in the previous year.

In August 2019, the number of applications for a mortgage loan increased by nearly 11% compared to August 2018. In terms of amount, there was also an increase of 11.5% compared to the previous year.

The increase in the number of credit applications occurred across all categories: loans for the purchase of a home (+4.5%), loans for home construction (+8.7%), loans for home renovations (+21%), loans for home purchase with renovation (+17%), and loans for other real estate purposes (+5.5%). The number of applications for external refinancing also saw a significant increase (+29.5%).

Granted Mortgage Loans

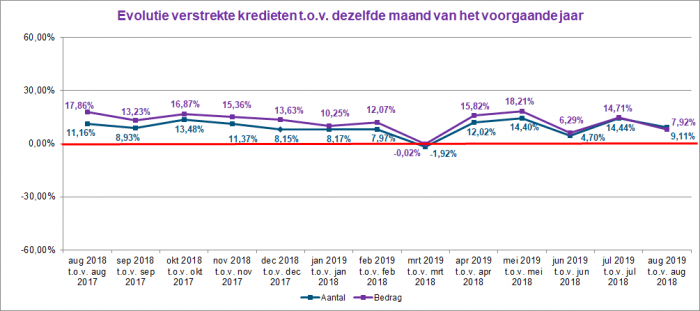

The following chart shows the evolution of granted mortgage loans, in terms of both the number and the amount, for the past twelve months. The monthly figures are compared to those of the same month in the previous year.

In August 2019, the number of granted mortgage loan agreements was slightly more than 9% higher than in August 2018. The corresponding loan amount also increased by approximately 8%..

The increase in the number of granted loans also occurred across almost all categories: loans for the purchase of a home (+3%), loans for home renovations (+16%), loans for home purchase with renovation (+19.5%), and external refinancing loans (+37%). Only the number of loans for home construction experienced a slight decline (-0.6%).