Enterprises again request more loans

26 February 2024 - 7 min Reading time

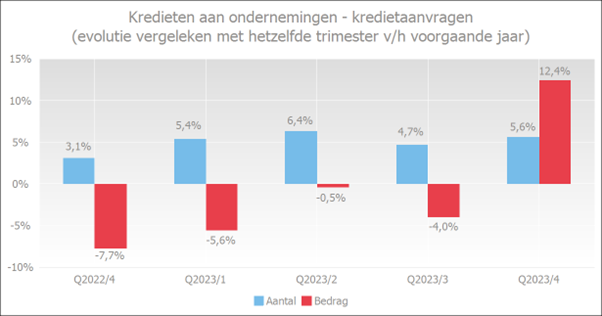

In the fourth quarter of 2023 5.6% more corporate loans were requested than in the same period of 2022, and the amount of these requested loans increased with 12.4%.

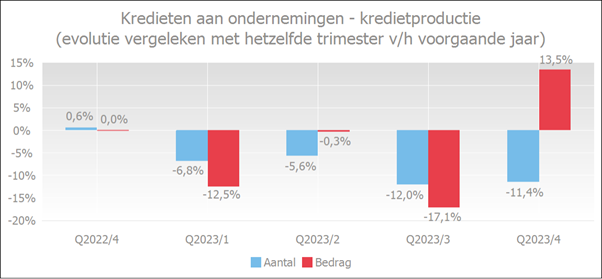

The amount of granted loans increased with 13.5% in the fourth quarter of 2023. The number of new loans fell by 11.4%.

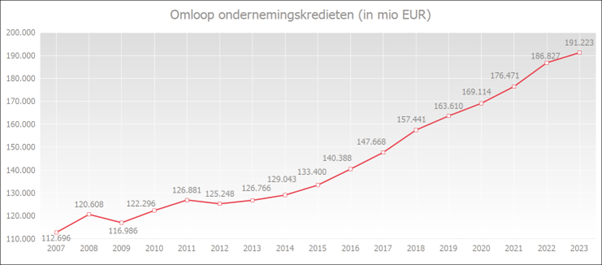

The increase of the credit production has not yet led to a particularly strong growth in the outstanding volume. That volume of corporate loans was 2.4% higher at the end of December 2023 than a year before and amounted to EUR 191.2 billion.

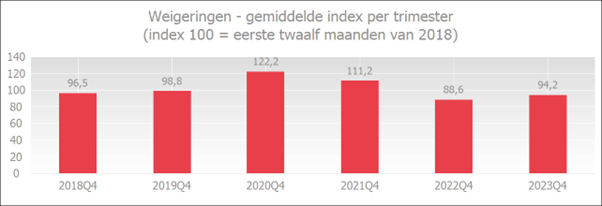

Compared to the fourth quarter of 2022, the degree of refusal was slightly higher in that same quarter of 2023.

Reviving credit demand drives higher production in amount

In the fourth quarter of 2023, entrepreneurs applied for 5.6% more loans than in the same period last year. In amount, there was a strong increase of 12.4%.

In the fourth quarter of 2023, the number of new credits fell by 11.4%. An increase was recorded for the amounts granted. The amounts were 13.5% higher in the fourth quarter of 2023 than in the same quarter of the previous year.

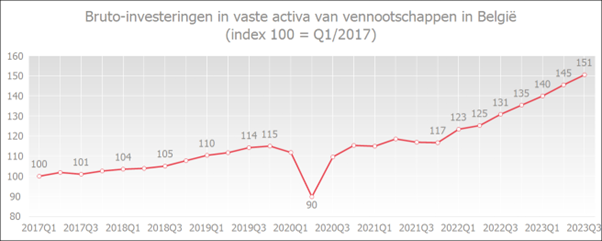

Thus, fewer loans are being issued, but for higher amounts. This may be related to the strong increase in business investment.

Source: NBB

Increasing credit production is not yet visible in the evolution of the outstanding amount of corporate loans

At the end of December 2023, the outstanding amount of corporate loans that were taken out, including commitment loans (such as guarantee loans and documentary credits), stood at EUR 191.2 billion, an amount that was 2.4% higher than in the previous year. In 2022 the annual growth still stood at 5.9%. The strong growth of the credit production in the fourth quarter of 2023 has not yet led to a growth acceleration in outstanding amounts.

Source: NBB

Entrepreneurs experience slightly more credit hurdles

Due to corrections, the new refusal grade can only be presented as from the beginning of 2018. According to Q4/2022, the refusal grade of Q4/2023 is slightly higher. This may indicate that banks have become somewhat more prudent, due to the uncertain economic situation and the increased interest rates. The refusal grade is however still significantly lower than during the COVID-19 pandemic, and also still lower than in the two years before the COVID-19 crisis.

The adjustments in the rejection process within the respective bank better reflect the reality in this way.

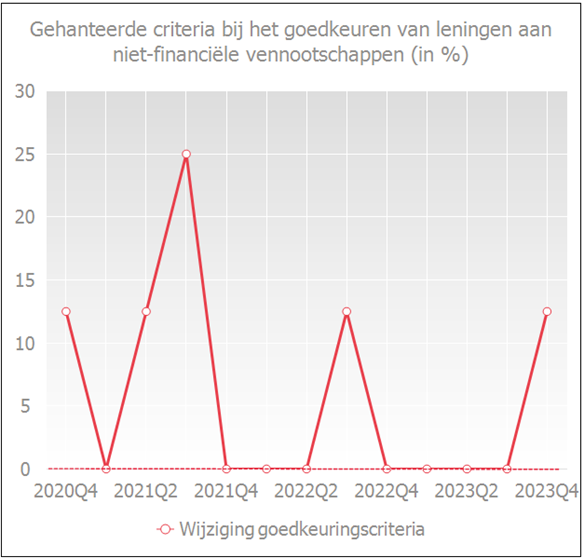

In the Bank Lending Survey, banks also indicate that they have strengthened their acceptance criteria in the fourth quarter of 2023. They also state that the most important reason for this is the uncertain economic situation.

Source: NBB

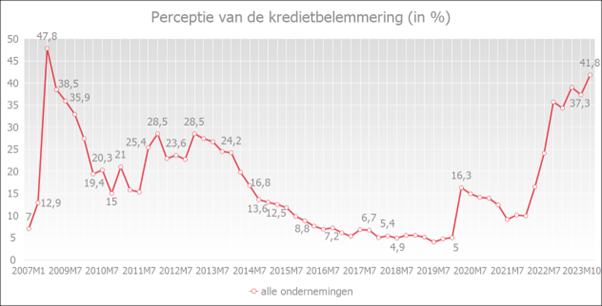

The perception of credit hurdles by enterprises however continues to increase since the beginning of 2022, which is in large part related to the increased interest rates. According to the quarterly survey of the National Bank of Belgium (NBB), the perception of credit hurdles by enterprises stood at 41.8% in October 2023. In January 2022, this perception only amounted to 9.9%. This can be explained almost completely by the increased interest rates. The weighted average interest rate has begun to rise since the beginning of 2022, due to the interest rate hikes of the ECB. This has increased the perception of credit hurdles by enterprises.

The chart below represents the evolution of the credit perception. A decrease points to an easing of credit conditions. An increase, on the other hand, indicates that enterprises consider it less beneficial to obtain a credit.

Source: NBB

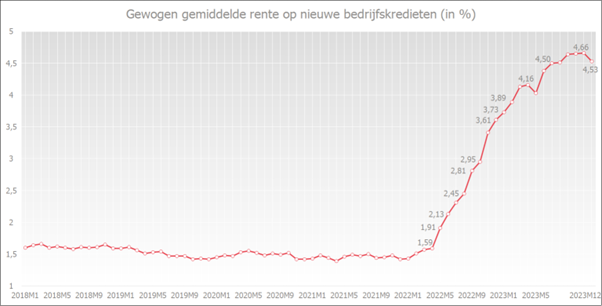

The interest rates for loans to enterprises seem to have reached their peak

According to the data of the NBB, the weighted average interest rate for new corporate loans has fluctuated around 1.5% for quite some time. As a result of the interest rate hikes of the ECB, it has begun to increase in the beginning of 2022, until 4.66% in November 2023. In December 2023, the weighted average interest rate for new corporate loans has started to decline again and the interest rate has fallen to 4.53%.

Source: NBB