A mixed picture in the field of mortgage lending in the first quarter

25 April 2024 - 11 min Reading time

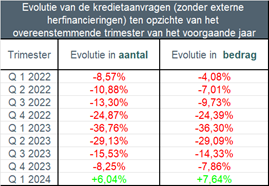

In the first quarter of 2024, the number of loan applications, excluding refinancings, increased by 6%. The corresponding credit amount also increased by 7.6% during this first quarter of 2024.

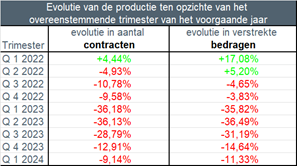

In the first quarter of 2024, about 39,500 mortgage credit agreements were concluded for a total amount of just over EUR 6 billion (excluding refinancings).

This represents a decline of more than 9% in the number of credit agreements issued compared to the first quarter of last year. Also in amount, about 11% less credit was granted compared to last year.

This is shown by the mortgage credit statistics published by the Professional Credit Association (UPC-BVK).

Together, the 50 members of the UPC-BVK account for about 90% of the total number of new mortgage loans granted (known as production). The total outstanding amount of mortgage credit of BMS members at the end of March 2024 is about EUR 281 billion.

The demand for mortgage loans is picking up again

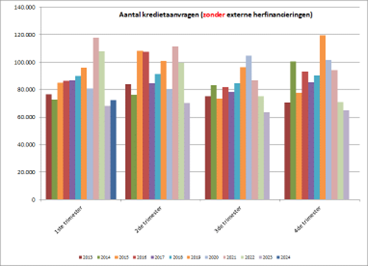

Credit demand recovered in the first quarter of 2024. Indeed, more than 72,000 loan applications were submitted in the first quarter of 2024, totalling just over EUR 13 billion (excluding refinancings).

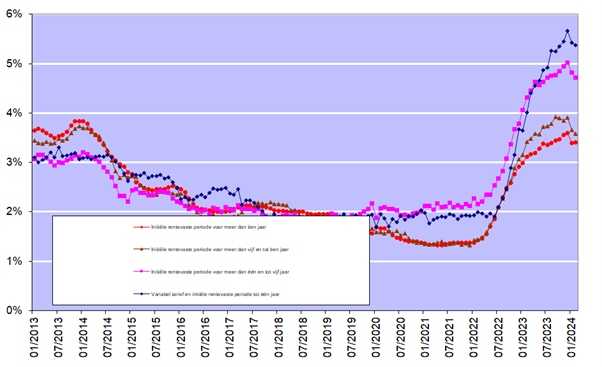

The first quarter of 2024 was marked by a slight fall in interest rates for mortgage loans. According to figures published by the National Bank of Belgium, these rates fluctuated between an average of 3.41% (for loans with an initial fixed interest period of more than 10 years) and an average of 5.38% (for loans with an initial fixed interest period of 1 year) in February.

"The number of loan applications is on the rise again, which is a first hopeful sign that could be reflected in production in the next quarter", declared Ivo Van Bulck, secretary-general of the Professional Credit Association.

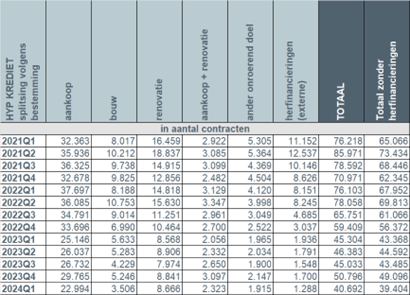

Below are the main findings for the first quarter of 2024 compared to the first quarter of 2023 (excluding refinancings):

- The number of credit applications (excluding those for refinancing) increased by just over 6% in the first quarter of 2024 compared to the first quarter of 2023. The amount of credit applications also increased by about 7.6% compared to 2023. Just over 72,000 credit applications were thus submitted for a total amount of just over EUR 13 billion.

- Mortgage loans were down (in number) by around 9% in the first quarter of 2024.The corresponding amount also fell by about 11% compared to 2023. A total of about 39,500 loans were granted, totalling more than EUR 6 billion (excluding refinances).

- Compared to the first quarter of 2023, construction loans (-2,127, or -37.8%) saw the steepest decline. A decline was also recorded in the number of loans for home purchase (-2,152, or -8.6%) and for other purposes (-50, or -2.5%). In contrast, the number of loans for purchase + remodelling increased the most (+267, or +13%) in the first quarter of 2024. The number of loans for renovations increased slightly (+98, or +1.1%) in early 2024.

- The number of external refinances (-648, or -33.5%) fell further in the first quarter of 2024, as the current interest rate environment is not favourable for this purpose. As a result, fewer than 1,300 external refinances were still granted in the first quarter of 2024, for a total amount of about EUR 190 million.

- The average amount borrowed for buying a house rose slightly in the first quarter of 2024 to about EUR 194,000. The average amount for a construction loan decreased slightly in the first quarter of 2024 to EUR 206,500. The average amount of purchase + remodelling credits also rose slightly in the first quarter of 2024, to EUR 187,000.

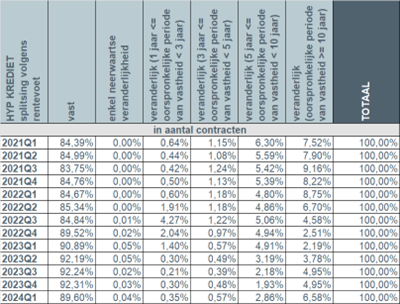

- In the first quarter of 2023, more than 9 out of 10 borrowers (96.2%) again chose a fixed interest rate or a variable interest rate with an initial fixed interest rate period of at least 10 years. Only 0.4% opted for a loan with an annually variable interest rate.

I. Number of credit applications is increasing

The number of credit applications, excluding those with regards to external refinancing, increased by almost 6% during the first quarter of 2024 compared to the same quarter last year. The underlying amount of credit applications also increased by about 7.6%.

Source: UPC-BVK

The number of credit applications increased for almost all purposes. Credit applications for buying a home (+2,436) increased by +5.8%, those for buying + remodelling a home (+373) by +9.4% and those for other purposes by +8.6% (+249). The number of credit applications for renovating a home (+1,909, or +16.5%) increased the most. Attractiveness for building a home remains weak and the number of loan applications continues to fall (-853, or -11.2%). Moreover, the number of applications for external refinancing decreased further, by -7.8%, given the current interest rate environment, which is not favourable for this purpose.

Bron: BVK

II. Number of loans granted in the first quarter

In the first quarter of 2024, the number of loans, excluding external refinancing, fell by just over 9% compared to the first quarter of 2023. The corresponding amount also declined with just over 11%.

Rising credit demand has not yet manifested itself in an increase in the number of loans granted. This is because there is usually a time frame of several months between the credit application and the drawing up of notarial deeds.

Source: UPC-BVK

III. Loans with “construction” purpose continue to decline

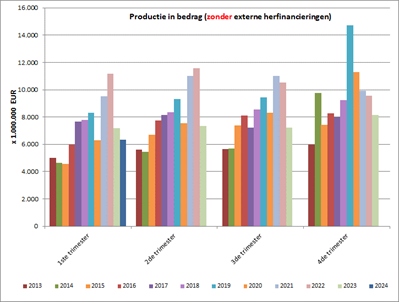

Just over 39,000 new loans were granted in the first quarter of 2024, totalling more than EUR 6 billion - excluding external refinancing. This is the lowest number since 2004. In terms of the amount granted in a first quarter, the level is the same as in 2020.

Overall, there was a 9% (in number) and 11% (in amount) decrease in the number of loans granted, excluding refinancings, compared with the first quarter of 2023. Only the number of loans for renovation or purchase + remodelling increased.

Compared to the first quarter of 2023, the number of loans taken out for home purchase (-2,152, or -8.6%) and construction loans (-2,127, or -37.8%) fell sharply. However, the number of loans for the purchase and remodelling of a home increased the most at +13%, or 267 more loans than in the first quarter of 2023. The number of loans for home renovation remained stable on a slight increase (+98, or +1.1%). The number of loans for other purposes (-50) fell further by -2.5% compared to 2023.

The number of external refinances decreased further by -33.5%. Consequently, less than 1,300 external refinances were granted for a total amount of around EUR 190 million.

Source: UPC-BVK

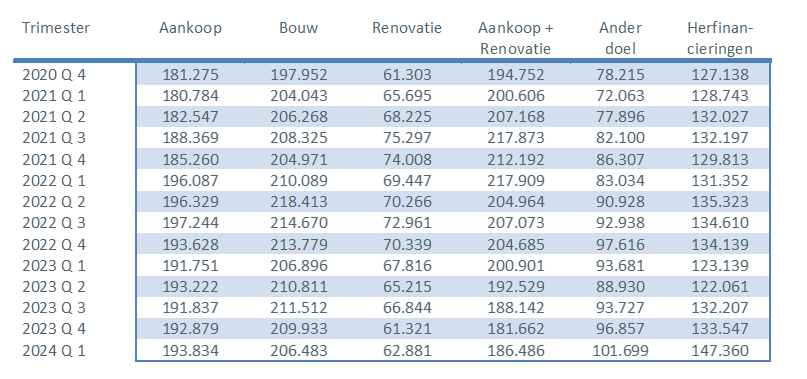

IV. Average amount of credit rises slightly

The average amounts of loans granted increased slightly in the first quarter for most purposes.

The average amount of a credit for the purchase of a home increased in the first quarter of 2024, reaching EUR 194,000.

The average amount of a credit for purchase + remodelling also went up again, to about EUR 186,500.

The average amount of a construction credit recorded a slight decrease in the first quarter of 2024, to just under 207,000 EUR, compared to the first quarter of 2023.

Source: UPC-BVK

V. 96% of borrowers again opt for a fixed interest rate

In the first quarter of 2024, more than 9 in 10 borrowers (96.2%) again chose a fixed rate or a variable rate with an initial fixed interest rate period of at least 10 years. About 3.3% of borrowers preferred a variable rate with an initial fixed interest rate period between 3 and 10 years. Less than 0.5% of borrowers opted for an annually variable interest rate.

Source: UPC-BVK

Taking into account the rising interest rates (see chart below), the majority of Belgian consumers thus continue to choose security. The number of people opting for a variable interest rate remains low. However, even in the case of a variable interest rate, consumers are highly protected by legislation. After adjustment to the evolution of the applicable reference indices, the variable interest rate can never be more than twice the initial interest rate.

Source: NBB Stat

Responsible mortgage lending remains the focus

The credit sector remains aware that mortgage lending must be carried out with great care, and responsible lending remains the top priority. In this regard, the sector aligns with the regulator: credit providers must exercise caution to prevent individual borrowers from taking on excessively large loans, on the one hand, and to preserve financial stability in the long term, on the other hand.

More info

Further information can be obtained from the press office (02 507 68 31 - press@febelfin.be).

Full statistics on mortgage credit (2000 - 2024Q1) broken down by credit purpose and type of interest rate are available on the website of UPC-BVK (www.upc-bvk.be) (only in Dutch/French) under the section "Press & figures".