Economic environment weighs on production of corporate loans

20 September 2023 - 6 min Reading time

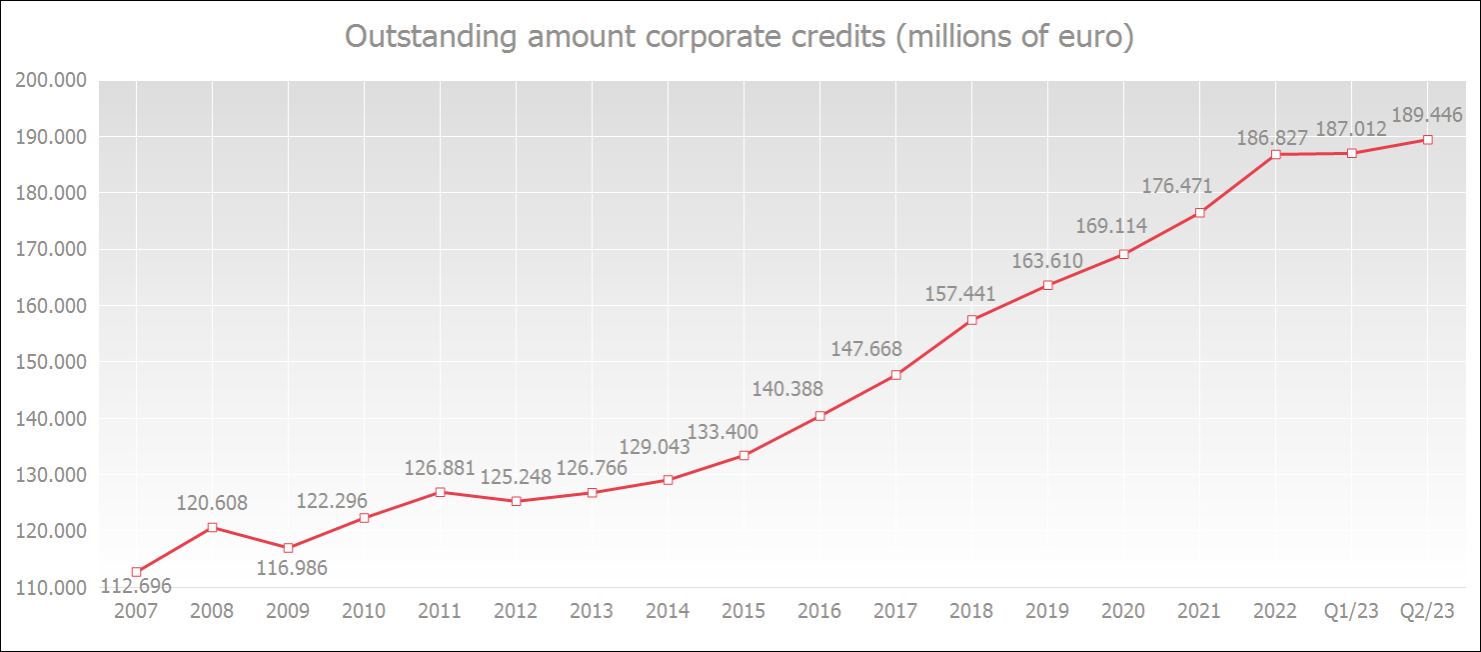

The outstanding volume of corporate loans at the end of June 2023 was 2.6% higher than a year earlier and amounted to 189.4 billion euros.

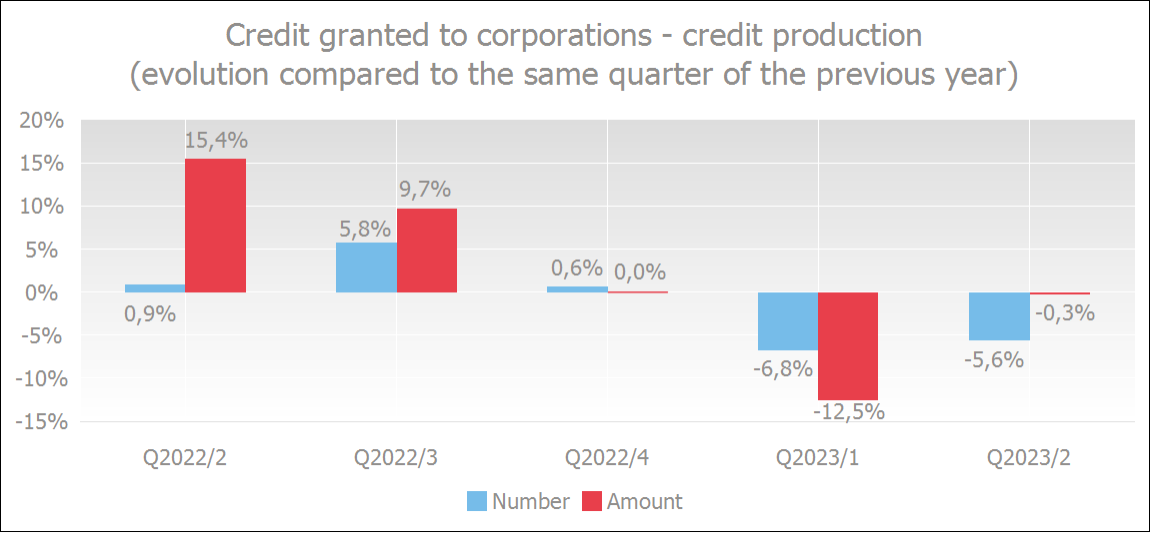

Both the number and amount of loans granted decreased. In the second quarter of 2023, 5.6% fewer loans were granted than in the same quarter of last year. The amounts provided were 0.3% lower.

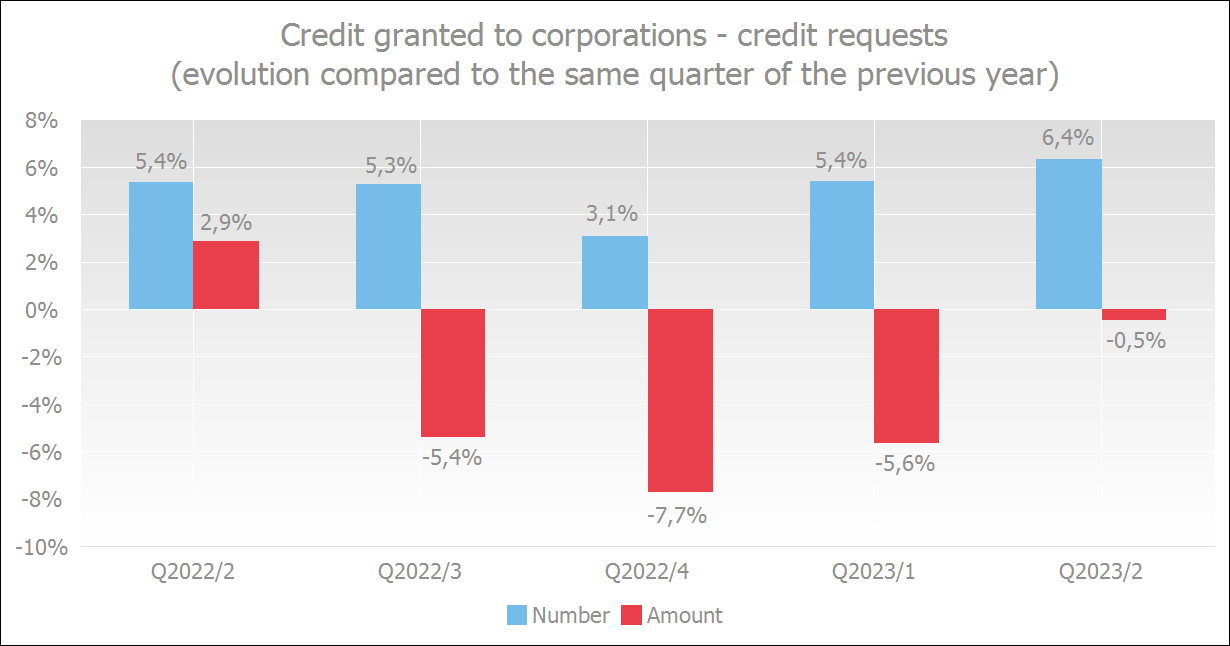

In the second quarter of 2023, 6.4% more business loans were applied for than in the same period of 2022, the total amount of these requested credits decreased quite slightly.

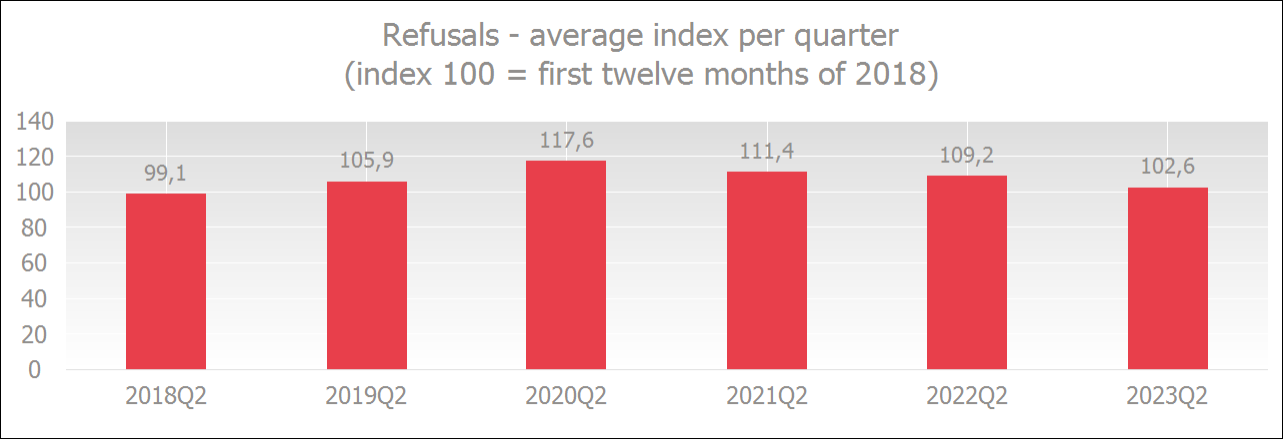

The refusal rate in the second trimester of 2023 was at the lowest level of all second trimesters since 2019.

Outstanding amount of corporate loans at a high level, but growth is slowing down

At the end of June 2023, the outstanding amount of corporate loans, including commitment credits, amounted to EUR 189.4 billion.

These are, for example, guarantee credits or documentary credits

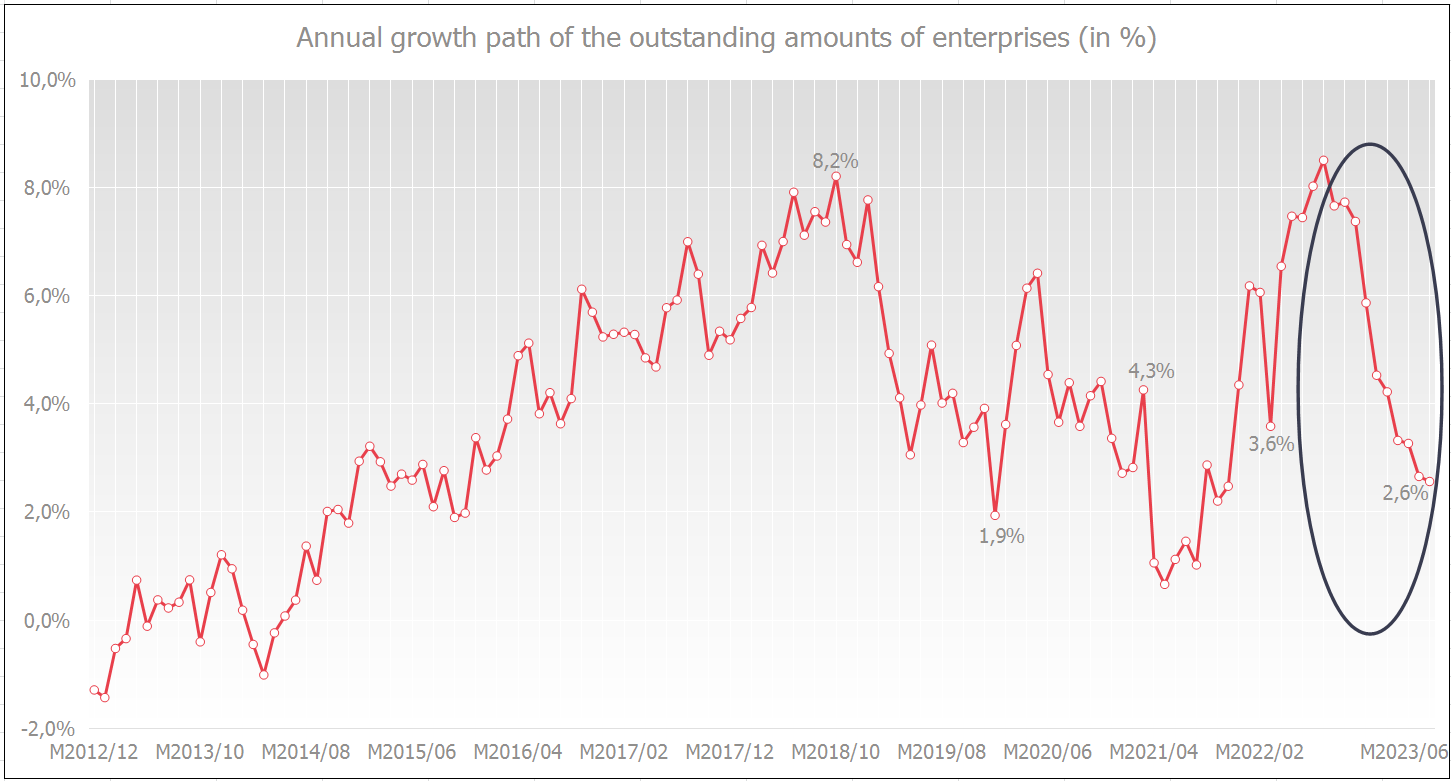

Compared to June 2022, the outstanding amount increased by 2.6% in June 2023. In 2022, annual growth was 5.9%, in 2021 it was 4.3%, while in the covid year 2020 it was only 3.4%. Circulation has continued to rise, but less strongly every month since August 2022 (8.5%) (compared to the same month last year) (see graph “annual growth path”).

Credit production decreases in number and amount

In the second quarter of 2023, the number of new loans fell by 5.6%. A decrease in the amounts provided was recorded for the second time in a row since the first quarter of 2021. The amounts in the second quarter of 2023 were 0.3% lower than in the same quarter of the previous year.

The fact that credit production decreases as circulation increases could indicate that entrepreneurs are taking up slightly more credit from their already granted credit lines.

Demand for new credit only weakens in amount

In the second quarter of 2023, entrepreneurs applied for 6.4% more loans than in the same period last year. However, in terms of amount there was a limited decrease of 0.5%. The reason why the demand for credit is decreasing in amount is probably related to a decrease in credit applications for fixed investments.

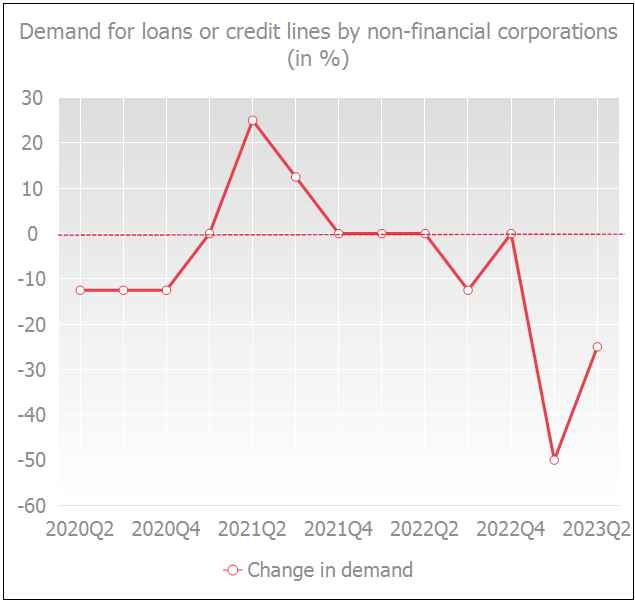

In the BLS (Bank Lending Survey) survey, the four major banks indicate that demand for loans or lines of credit by non-financial corporations fell in the second quarter of 2023 and that this decline was less pronounced than in the first quarter of 2023.

Source: ECB / NBB

In de grafiek komt een positief (negatief) percentage overeen met een toename (afname) van de kredietvraag. Een nul percentage komt overeen met een stabilisering.

Entrepreneurs experience fewer credit barriers

Due to corrections, the new refusal rate can only be displayed from the beginning of 2018. The refusal rate of the second trimester of 2023 was at the lowest level of all second trimesters since 2019.

In this way, the adjustments within the refusal process of a bank better reflect reality.

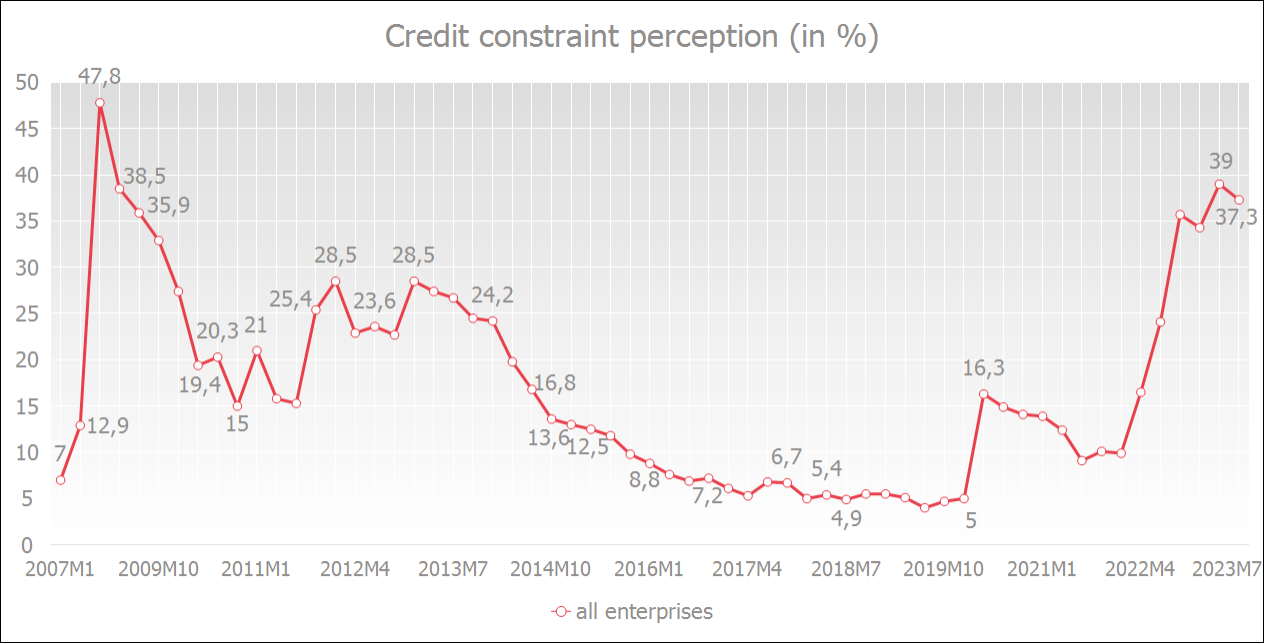

The results of the quarterly survey of the National Bank of Belgium (NBB) on the perception of credit barriers among companies also indicate that banks have slightly relaxed their credit conditions.

The share of companies that considered credit conditions to be unfavorable was 37.3% in July 2023, while in April 2023 it was still 39.0%. Only very large companies considered that credit conditions had evolved negatively in July 2023.

The graph below shows the evolution of credit perception. A decline indicates an easing of credit conditions. An increase indicates that, according to companies, it is less advantageous to obtain credit.

Interest rates are rising

According to NBB data, the weighted average interest rate on new corporate loans was 4.37% in June 2023 (compared to 4.07% in May 2023). In July 2023, that interest rate rose even further to 4.47%. Interest rates have hovered around 1.5% for a number of years, but as of February 2022 they have started to rise due to higher market rates.

Source: NBB