Decline in mortgage lending continues in the second quarter

9 min Reading time

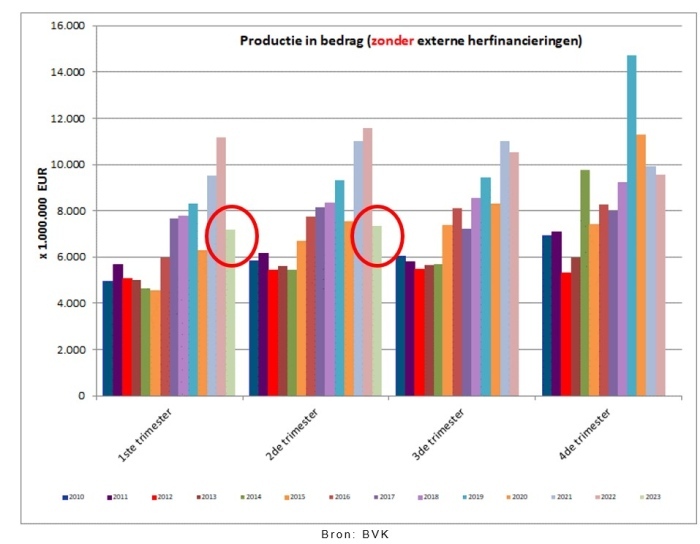

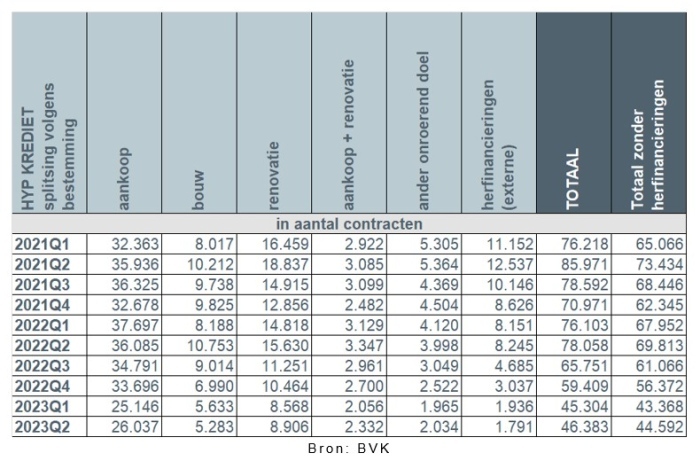

In the second quarter of 2023, approximately 44,600 mortgage credit agreements were concluded for a total amount of about 7.4 billion EUR (excluding refinancing).

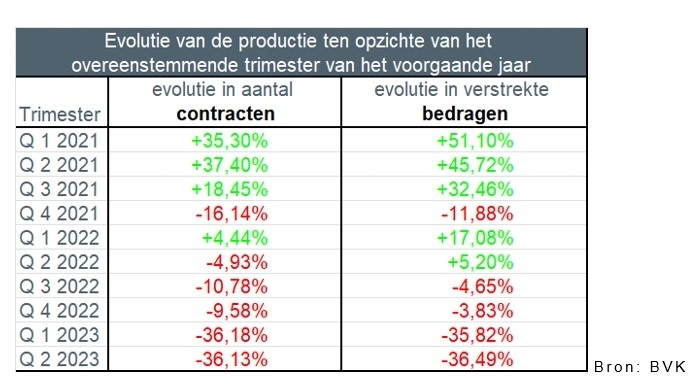

This represents a decrease in the number of credit agreements granted by more than 36% compared to the second quarter of the previous year. There was also approximately a 36% decrease in the amount of credit granted compared to that period.

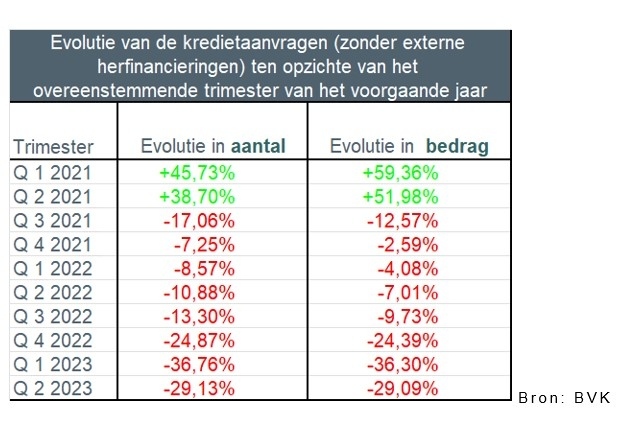

Excluding refinancing, the number of credit applications in the second quarter of 2023 decreased by about 29% compared to the second quarter of 2022, and there was also a decrease in the amount of about 29%.

These findings are based on mortgage credit statistics published today by the Professional Association of Credit (BVK).

De 50 leden van de BVK nemen samen ongeveer 90% van het totaal aantal nieuw verstrekte hypothecaire kredieten (de zogeheten productie) voor hun rekening. Het totale uitstaande bedrag aan hypothecair krediet van de BVK-leden bedraagt einde juni 2023 ongeveer 276 miljard EUR

Declining demand impacts credit issuance

The demand for credit remained very low in the second quarter of 2023 compared to the previous year, as it was in the previous quarter. As a result, credit issuance remains substantially lower than in the previous year.

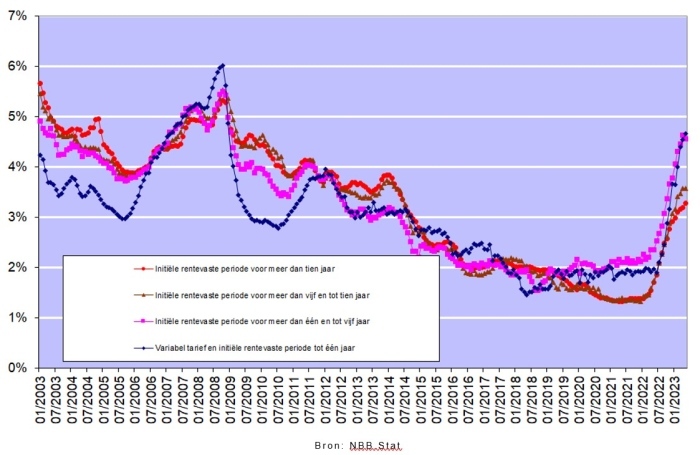

Interest rates for mortgage loans continued to trend upward in the past quarter. According to figures published by the National Bank of Belgium, the average interest rates in May ranged from 4.66% (for loans with an initial fixed interest period of up to 1 year) to 3.28% (for loans with an initial fixed interest period of more than 10 years).

The number of credit applications (excluding those for refinancing) decreased by just over 29% in the second quarter of 2023 compared to the second quarter of 2022. The amount of credit applications also decreased by about 29% compared to 2022. As a result, just over 70,000 credit applications were submitted for a total amount of nearly 13 billion EUR.

The granted mortgage loans decreased in number by approximately 36% in the second quarter of 2023 compared to the second quarter of the previous year. The corresponding amount also decreased by about 36% compared to 2022. In total, slightly more than 44,500 loans were granted for a total amount of nearly 7.4 billion EUR (excluding refinancing).

The number of loans for other purposes (-1,964, or -49.1%) experienced the most significant decline in the second quarter of 2023, along with the number of loans for home construction (-5,470, or -51%). There was also a substantial decline in the number of loans for home renovations (-6,724, or -43%) and loans for home purchase with renovation (-1,015, or -30.3%). The number of loans for home purchases (-10,000, or -28%) also decreased significantly.

The number of external refinancing loans (-6,454, or -78%) experienced a spectacular decrease in the second quarter of 2023, as expected in a rising interest rate environment. Consequently, fewer than 1,800 external refinancing loans were granted for about 219 million EUR.

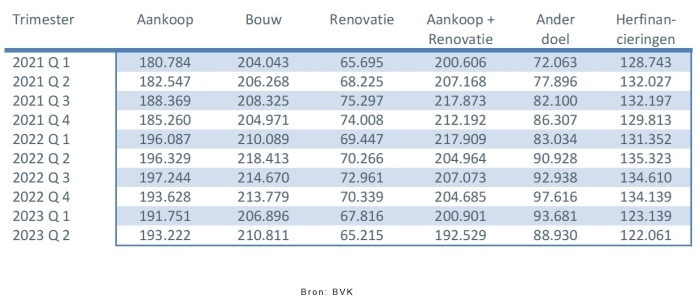

The average loan amount for home purchase slightly increased in the second quarter of 2023, reaching approximately 193,000 EUR. The average amount for a construction loan also saw a slight increase, totaling 211,000 EUR in the second quarter of 2023. However, the average amount of loans for home purchase + renovation further declined to just over 192,500 EUR.

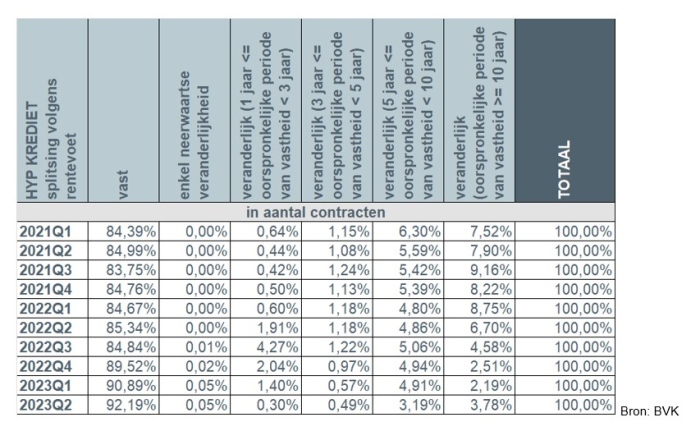

In the second quarter of 2023, noticeably more borrowers (96%) once again chose a fixed interest rate or a variable interest rate with an initial fixed interest period of at least 10 years. In only 0.3% of cases did borrowers opt for an annually variable interest rate.

I. Number of Credit Applications Remains at a Low Level

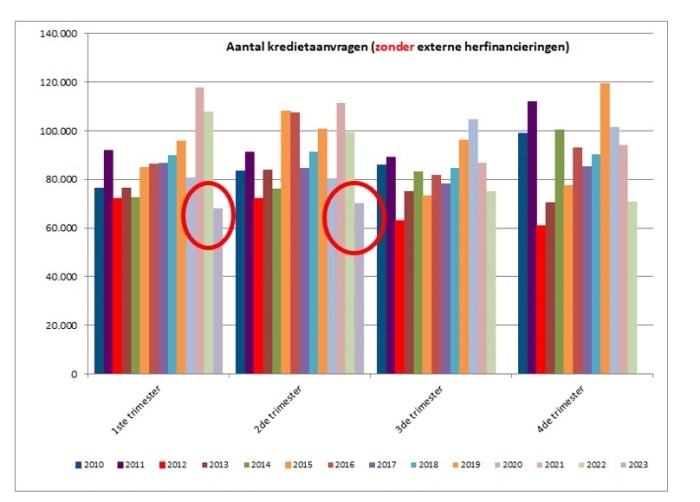

The number of credit applications, excluding those related to external refinancing, experienced a decrease of approximately 29% during the second quarter of 2023 compared to the same quarter of the previous year. The total amount of the credit applications also decreased by about 29%. For the second consecutive quarter, the number of credit applications for the respective quarters (excluding those for refinancing) remained at its lowest level since 2010.

The decrease in the number of credit applications was observed across all purposes. Credit applications for home purchases (-13,184) decreased by -22.7%, those for home purchase + renovation (-524) decreased by -10%. There was also a significant decline in credit applications for home renovation (-6,027, or -34.8%), as well as credit applications for other purposes such as garages, land purchases, etc. (-1,970, or -38.8%). The number of credit applications for home construction (-7,224, or -52.7%) also saw a substantial decrease. Furthermore, the number of applications for external refinancing experienced a dramatic drop of -63.5%, which is not surprising in the current rising interest rate climate.

II. Number of Granted Loans in the Second Quarter

In the second quarter of 2023, the number of granted loans, excluding external refinancing, decreased by approximately 36% compared to the second quarter of 2022. The corresponding total loan amount also decreased by about 36%.

The decreasing demand for credit corresponds to a proportional decrease in the number of granted loans.

III. Decline regardless of loan purpose

During the second quarter of 2023, slightly more than 44,500 new loans were granted for a total amount of nearly 7.4 billion EUR, excluding external refinancing. This is the lowest number of loans granted in a second quarter in nearly 20 years. In terms of total amount, there hasn't been a lower amount of credit granted during a second quarter since 2015.

Overall, there was a decline of approximately 36% in the number of loans granted in the second quarter of 2023 compared to the second quarter of 2022, and this decline was evident for all loan purposes.

The number of loans for home purchase (-10,000, or -27.8%), loans for home renovation (-6,724, or -43%), and loans for home purchase with renovation (-1,015, or -30.3%) all saw significant declines compared to the second quarter of 2022. However, the number of construction loans experienced the most substantial decline, with -50.9% or 5,470 fewer loans than in the second quarter of 2022, as did the number of loans for other purposes (-1,964), which decreased by -49.1%.

In addition, during the second quarter of 2023, the number of external refinancing loans again experienced a spectacular drop of 78.3%. Consequently, fewer than 1,800 external refinancing loans were granted for a total amount of approximately 219 million EUR.

IV. Average loan amount slightly increasing

The average loan amounts granted in the second quarter increased slightly.

The average loan amount for home purchase increased to approximately 193,000 EUR in the second quarter of 2023.

Similarly, the average loan amount for home construction experienced a slight increase, reaching nearly 211,000 EUR in the second quarter of 2023. However, the average loan amount for loans used for home purchase + renovation continued to decrease, reaching approximately 192,000 EUR.

V. 96% of borrowers opt for a fixed interest rate

In the second quarter of 2023, once again, more than 9 out of 10 borrowers, specifically 96%, chose either a fixed interest rate or a variable interest rate with an initial fixed interest period of at least 10 years. Approximately 4% of borrowers opted for a variable interest rate with an initial fixed interest period between 3 and 10 years. Barely 0.3% of borrowers opted for an annually variable interest rate.

Taking into account the rising interest rates (see chart below), Belgian consumers continue to overwhelmingly choose security. The number of individuals opting for a variable interest rate remains low. However, even in the case of a variable interest rate, consumers are highly protected by legislation. The variable interest rate, after adjustment to the evolution of the applicable reference indexes, can never exceed twice the initial interest rate.

Responsible mortgage lending remains the priority

The credit sector remains aware that mortgage lending should be approached with great care, and responsible lending remains the absolute priority. On this point, the sector aligns with the regulator: credit providers must exercise the necessary caution to prevent individual borrowers from taking on excessively large loans and, in the long term, safeguard financial stability.