Consumer credit for energy renovations shows downward trend in first quarter of the year

22 May 2024 - 3 min Reading time

Credit sector draws attention to urgency of energy-efficient home renovations

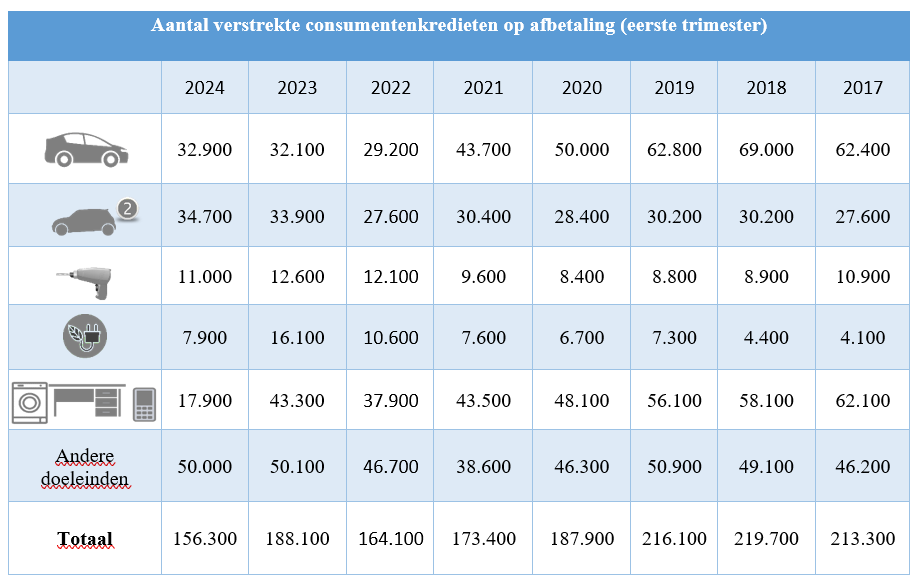

The Professional Credit Association (UPC-BVK), which represents 95% of the credit market in Belgium, has analysed consumer credit figures for the first quarter of 2024. In total, some 156,000 credits were granted in the first three months of this year, amounting to €2.5 billion, a decrease in the number of new credit agreements of almost 17% compared to the same period last year. The number of consumer loans granted for energetic home renovations is actually down 51% to 7,852 credit agreements after records from 2022.

Consumer loans for energy renovation purposes were taken out in the first quarter of the year for a total value of EUR 167 million, down almost 40% in value compared to the same period last year. Mortgage loans for the purchase and/or renovation of a home are excluded from these figures.

The decline in consumer loans for energy-efficient renovations is mainly caused by a combination of factors, including rising interest rates and increasing costs for building materials due to inflation. This combined with significant price declines in the energy field, creates a lack of significant incentive for consumers to undertake energy-saving initiatives in their homes. This is also confirmed by Bart Vervenne, Chairman of the Board of Directors of BMS:

"In view of the 2050 targets for all homes in Belgium to be energy efficient, renovations are essential. Currently, less than 10% of homes meet the 2050 target, while only a third of the targeted renovation rate is met. A massive renovation surge within 10 or 15 years will only lead to scarcity of building materials (and thus higher prices), manpower and financing. The only way to improve the energy performance of our housing stock is to proceed gradually and act now. Consumer credit plays an important role in financing energy-saving measures, such as installing solar panels, heat pumps and insulation. It is vital that all available awareness-raising resources are fully mobilised to meet the 2050 targets. An additional problem is also that some 20-25% of Belgians have neither the savings nor the repayment capacity to carry out energy renovations, solutions need to be found for that too."

An increase in figures, on the other hand, can be noted in the category of cars. A total of 67,600 loans were granted for the purchase of a car totalling about EUR 1.3 billion. This is an increase of 2.7% compared to the same period last year.

Consult the annual report on the UPC-BVK website: https://www.upc-bvk.be/nl/press/annual-reports (only in Dutch/French)

For more information on this topic, please consult the website https://consumentenkredietvoormorgen.be/ / https://creditconsopourdemain.be/ (only in Dutch/French)