Mobile apps make Belgians more conscious of banking

27 February 2019 - 8 min Reading time

Today's consumers handle their banking differently than they did, say, fifteen years ago. Febelfin observes that customers are increasingly managing their banking affairs digitally. Mobile banking, in particular, is on the rise. According to a survey by iVOX of 1,000 individuals, 4 out of 5 Belgians use mobile apps. Of these, 76% are satisfied with the user-friendliness and capabilities of their apps.

Thanks to online and mobile applications, we are in much closer contact with our banks. The average user checks their account via the mobile app approximately 22 times per month. Furthermore, the survey reveals that 65% of users indicate they have a much better understanding of their financial situation today, compared to the past, thanks to the advent of banking apps. In 2019, Belgians are banking much more consciously.

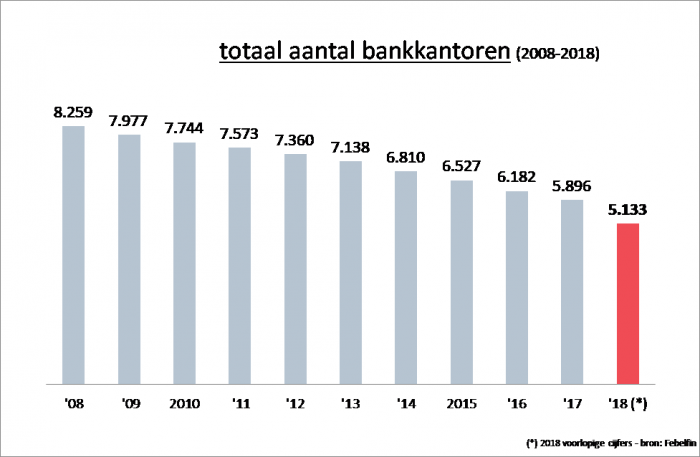

The new digital possibilities bring banks closer to their customers. Managing your finances is only a few clicks away. However, even those who do not yet use digital solutions are not left out in the cold. Belgium still has one of the densest branch networks in Europe, with 5,133 branches in 2018.

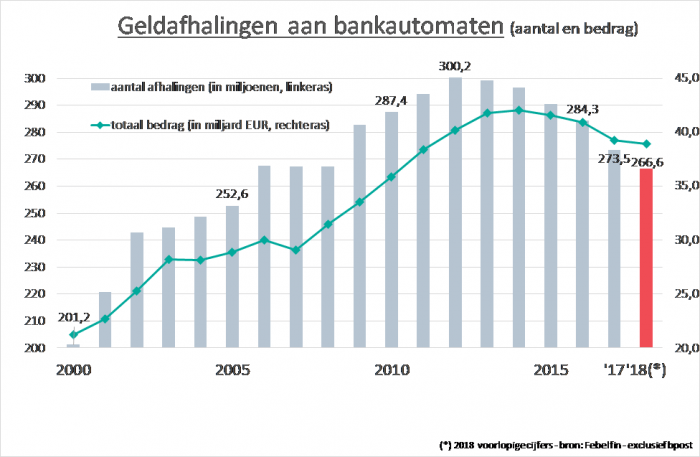

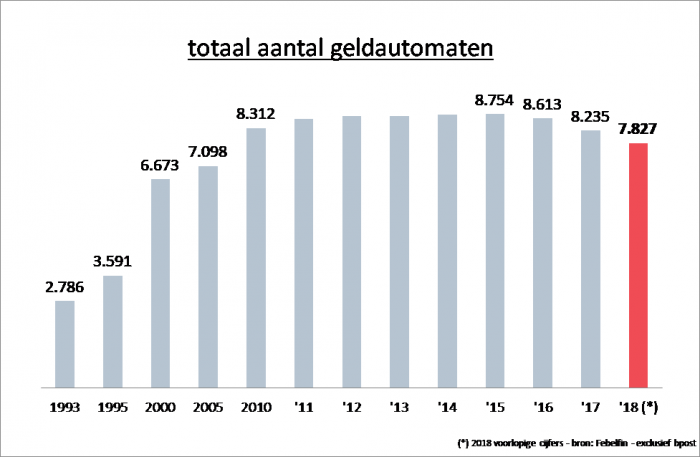

While digital banking is clearly on the rise, Belgians are slower to adopt digital or electronic payments. Cash remains a widely used payment method in Belgium. However, in recent years, both the number of cash withdrawals and the total amount withdrawn have been on a downward trend. The number of ATMs available to customers also follows this trend. Nevertheless, Belgians still have access to 7,827 ATMs.

In the coming years, the financial sector aims to continue making digital banking and payments more user-friendly and contemporary. This will be done with great respect and attention to customers who are taking a slower pace towards this digital environment. Therefore, the physical offering will continue to hold an important place in the service alongside the digital.

Belgians are increasingly opting for internet and mobile banking

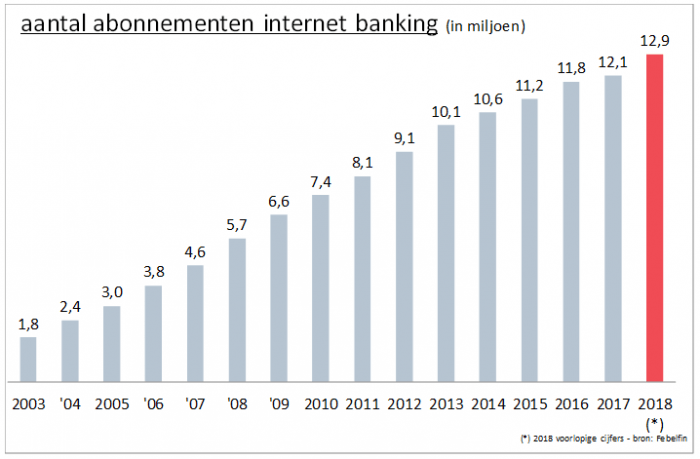

Internet banking continues to grow each year. At the end of last year, there were a total of 12.9 million subscriptions in circulation. If we go back fifteen years, internet banking was still quite limited. In 2003, there were only 1.8 million subscriptions.

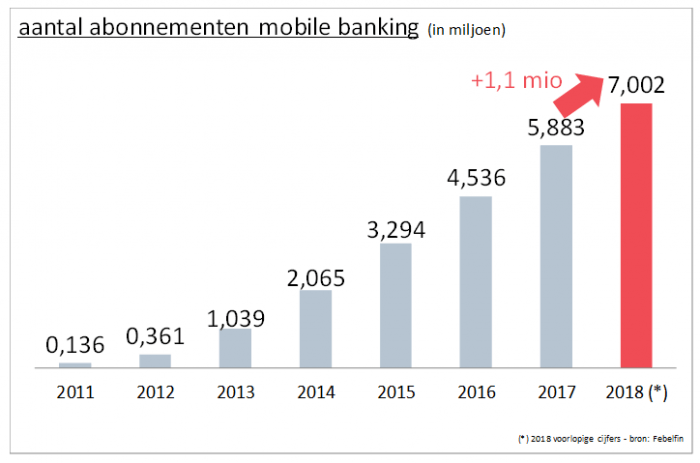

In the case of mobile banking, the growth is even more spectacular. In 2011, this form of banking cautiously emerged with 0.14 million subscriptions. By the end of last year, mobile banking had skyrocketed to a whopping 7 million subscriptions.

This indicates that Belgians are embracing digital banking and appreciate the ability to carry out their daily transactions themselves: checking account statements, making transfers, etc.

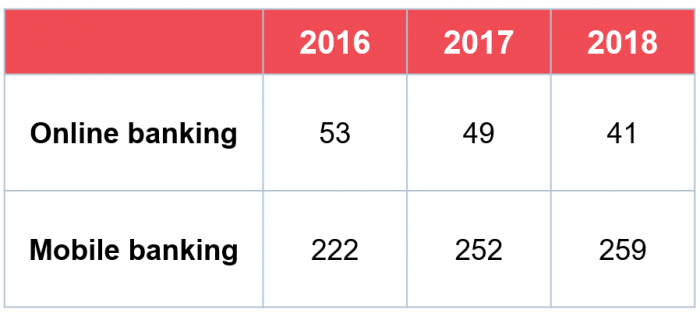

The average user consults their mobile banking app about 22 times a month, while they perform online banking on a PC an average of 3 times a month.

Looking at the number of transfers Belgians make, we can see that mobile banking is playing an increasingly significant role. Online, Belgians conduct 53% of their transfers, while mobile accounts for 40%. A percentage that was nearly nonexistent five years earlier (3%).

While mobile banking is thriving, the share of self-service banking transactions is steadily declining. In 2018, only 7% of all transfers were made at a self-service banking machine. A decade earlier, it was still 21%.

The iVOX study confirms the popularity of mobile banking

The popularity of mobile banking is also evident from a survey conducted by iVOX among 1,000 Belgians in February 2019.

4 out of 5 Belgians report using one or more mobile banking apps.

Moreover, they are satisfied with the apps: 76% of users are somewhat to completely satisfied with the user-friendliness and capabilities of their banking apps.

The survey also reveals that 65% of users now have a much better understanding of their financial situation compared to before, thanks to the arrival of banking apps. Furthermore, when asked if they feel more engaged with their finances now, only 29% of users responded negatively.

Klant betaalt liefst digitaal

In its Great Payment Survey, Bancontact surveyed 1,000 Belgians in 2017 about their preferred payment method. The debit card emerged as the favorite with 64%, holding a substantial lead.

This is also reflected in the number of card payments: in 2017, Belgians used their debit or credit cards a staggering 1.883 billion times.

In contrast, there are cash payments and associated ATM withdrawals. In 2018, Belgians made an average of 23 cash withdrawals from their bank annually, with an average amount of 145.7 euros. Over the past few years, both the number of withdrawals and the withdrawn amount have been steadily declining.

The number of ATMs where customers can withdraw money follows this trend. Their number has been gradually reduced over the past few years. Nevertheless, Belgians still have access to 7,827 ATMs. In comparison to ten years ago, there are even more ATMs available today.

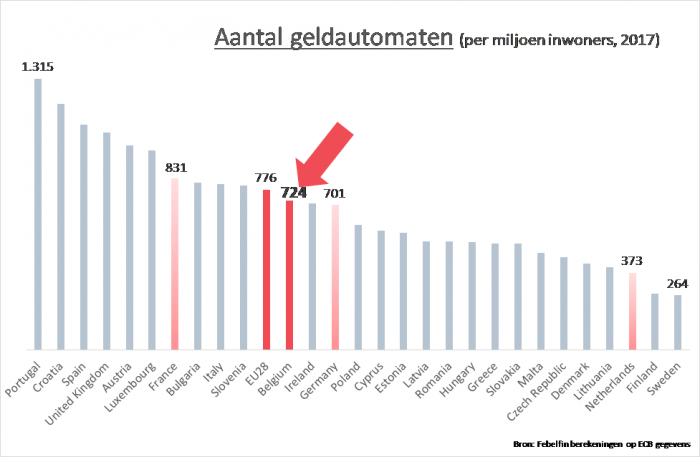

Within Europe, the number of ATMs in Belgium is close to the average. However, the situation in our country is unique. In southern countries, the number of ATMs is much higher, but digital banking is still in its infancy there. In northern countries, such as the Netherlands, for example, you need to make more effort to find an ATM. Digital banking is, figuratively speaking, part of the population's DNA there. Belgian banks offer the best of both worlds: the option to withdraw money from an ATM and a sophisticated digital payment environment.

Customers can now access both physical and virtual bank branches

As Belgian customers increasingly engage in digital banking themselves, they visit physical bank branches less frequently than before. Moreover, tasks for which they used to visit a bank branch can now be easily accomplished online, such as adjusting credit limits, ordering a debit card, reporting a lost credit card, and more.

Banks closely monitor this societal trend and align their branch offerings accordingly. However, this doesn't mean that in 2019, Belgian consumers can no longer visit a physical branch.

By the end of 2018, Belgium had a total of 5,133 bank branches.

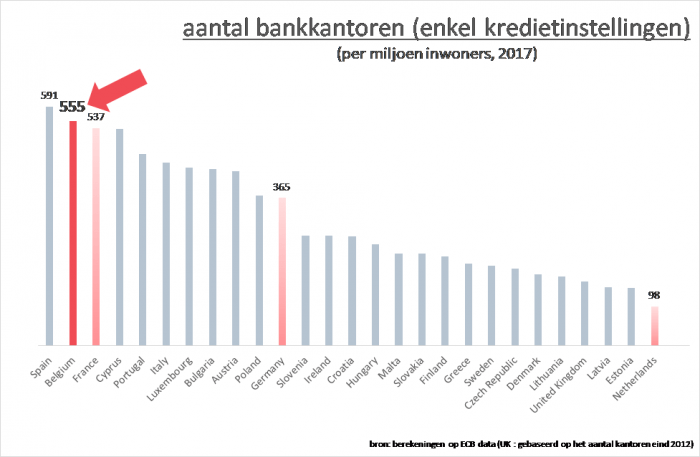

Belgium has one of the densest branch networks in Europe: with 555 branches per million inhabitants, only Spain surpasses us. Netherlands has 98 branches per million inhabitants. In other words, it's nearly one-sixth of the number of branches in Belgium.

Belgian banks often redefine the traditional bank branch. The bank of the future will serve as a point of contact for personalized advice rather than a platform for everyday transactions. Today, we already see such branches emerging with extended opening hours and a very customer-friendly design.

Furthermore, an increasing number of banks are establishing virtual contact points where customers can turn with their questions far beyond the usual opening hours.

Belgian banks are thus perfectly catering to the needs of their customers and can offer customized services.

The significant advantage of the digital revolution: the many possibilities bring the bank closer to its customers than ever before. This intensifies the relationship between the bank and its customers, making it stronger.