Febelfin launches the first Digital Payment Day in collaboration with trade federations

23 April 2019 - 12 min Reading time

While 63% of all payments in our country are still made in cash, a whopping 89% of Belgians prefer a digital payment solution over cash. This is according to a survey conducted by iVOX on behalf of Febelfin.

For more than half of Belgians, the simple absence of the option to pay with a card or smartphone is the primary reason for using cash. This is a source of frustration for many, with 11.4% of Belgians having left a retail store because there was no digital payment option available.

However, there is still a significant amount of distrust and lack of knowledge among consumers regarding new payment solutions such as contactless payments and smartphone payments.

To give digital payments a strong push, Febelfin is launching the campaign "Pay digitally. It's the new normal." in preparation for Digital Payment Day on Saturday, May 11th, in collaboration with Bancontact Payconiq Company, Mastercard, Visa, Unizo, UCM, Comeos, Worldline, NSZ, SDZ, CCV, and Europabank.

With Digital Payment Day, Febelfin calls on Belgian merchants and consumers to choose digital payment methods massively by May 11th. CEO Karel Van Eetvelt will travel across Belgium on May 11th to personally recognize the merchants who enable digital payments.

Especially young Belgians opt for the payment app

Although the majority of payments in our country are still made with cash, an increasing number of Belgians prefer digital payment. The iVOX study reveals that a whopping 89% of Belgians prefer a digital payment solution over cash.

iVOX study of April 2019, conducted at the request of Febelfin

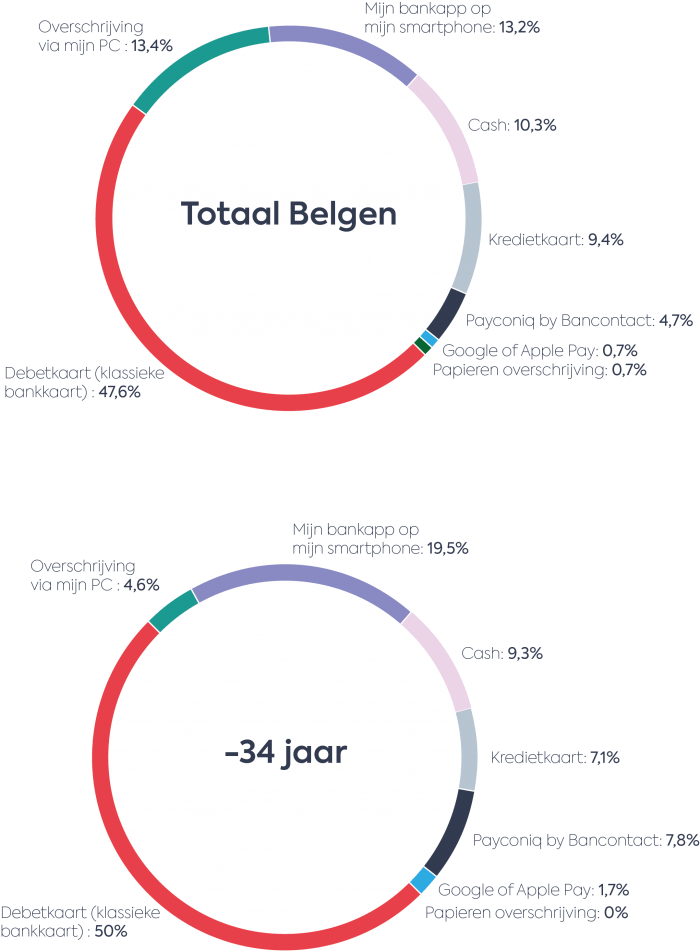

Nearly half of the Belgians prefer to pay with a debit card. Additionally, about 19% prefer a payment app (bank app, Payconiq by Bancontact, Google or Apple Pay), and 9.4% opt for a credit card. Among young Belgians under the age of 34, payment apps are even more popular. Within this demographic, 29% choose a payment app as their preferred payment solution. Mobile payment is on the rise. For instance, Bancontact Payconiq Company recorded 34 million mobile payments in the past year, doubling compared to 2017.

Today, consumers clearly expect to be able to pay with a card or smartphone everywhere and in every situation. However, it is not yet a given everywhere. It is our mission as a banking federation to make payments as safe and easy as possible for the consumer and to provide the best possible guidance to merchants.

Our country is lagging behind, compared to our northern neighbours

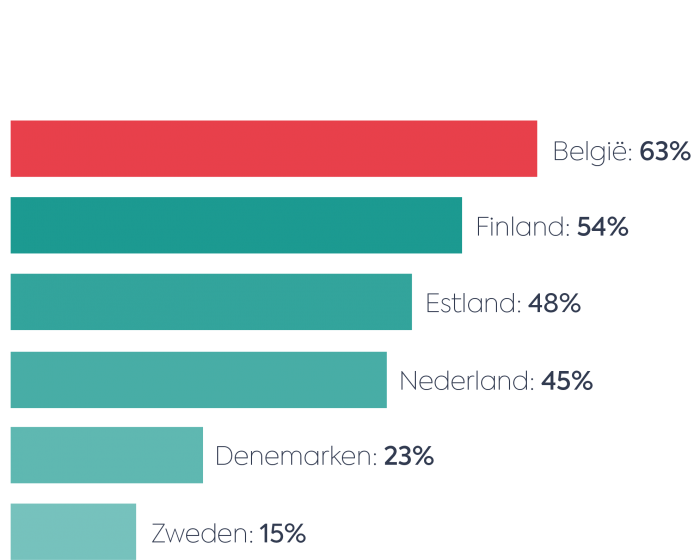

IIn Belgium, 63% of all payments are still made in cash. This was previously revealed in a study by the European Central Bank.

The use of cash by households in the euro area, study conducted by the European Central Bank (ECB), November 2017 (data for 2016).

Belgium performs worse than its neighbouring country, the Netherlands, where the majority of payments are digital. Only 45% of all payment transactions in Dutch retail locations are still made in cash. Denmark is an absolute example when it comes to digital payments. Barely 23% of all payments are still made in cash there.

Waarom betaalt de Belg dan nog zo vaak met cash? Nog ongeveer één op vijf Belgen (19,4%) betaalt met cash uit pure gewoonte, blijkt uit de iVOX-studie. Er bestaat dus vaak nog terughoudendheid of zelfs enige schaamte bij de consument om kleine bedragen digitaal te betalen. Volledig onterecht, hier is dus nog een echte gedragswijziging nodig.

Maar voor meer dan de helft (50,1%) van de Belgen is simpelweg het ontbreken van de mogelijkheid om met de kaart of de smartphone te betalen de grootste reden om nog cash geld boven te halen. De meerderheid geeft duidelijk wel de voorkeur aan digitaal betalen. Want bijna de helft van de Belgen (48,4%) die cash betaalde, had liever met de kaart betaald als dat mogelijk was geweest.

Why do Belgians still use cash so often? According to the iVOX study, approximately one in five Belgians (19.4%) still pays with cash out of sheer habit. It appears that there is often reluctance or even some embarrassment among consumers when it comes to paying small amounts digitally. This is entirely unjustified, and a real change in behavior is still needed.

However, for more than half (50.1%) of Belgians, the simple absence of the option to pay with a card or smartphone is the main reason for resorting to cash. The majority clearly prefers digital payments. Because nearly half of Belgians (48.4%) who paid with cash would have preferred to pay with a card if that had been possible.

The 5 biggest advantages of paying with a card or smartphone are:

- It is easy (57%)

- I don't need to carry cash (54.8%)

- I don't have to go to the ATM (45.5%)

- It is fast (44.2%)

- It is simple (44.2%)

Part of the explanation lies in the fact that not all merchants today offer digital payment options, and this doesn't sit well with everyone. In fact, 11.4% of Belgians have even walked away from a business where card payment was not possible. Among young people, this number is even higher, with more than 20% of young Belgians under the age of 34 having left a store for this reason. According to Febelfin, this indicates that merchants who do not offer digital payment options discourage customers and potentially suffer losses as a result.

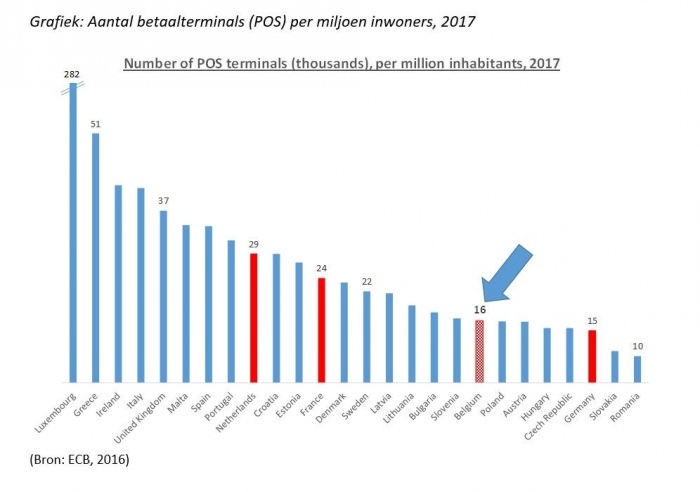

The fact that there is still room for improvement among Belgian merchants is also confirmed by the European Central Bank's figures. According to the ECB, Belgium has 16,000 point-of-sale (POS) terminals in shops per million inhabitants. This places our country at the bottom end of the European rankings. In Denmark, for instance, they have 23,000 POS terminals per million inhabitants, and the Netherlands leads the way with 29,000 POS terminals per million inhabitants.

Belgians still have too little confidence in the latest payment technology

Today, only 5% of all card transactions in our country are contactless. Contactless payment has quietly started to gain ground, but compared to other European countries, Belgium lags behind. In the Netherlands, more than half of transactions are already contactless. In Eastern European countries such as Hungary (82%) and the Czech Republic (93%), contactless payments are fully integrated.

The iVOX research shows that more than half of Belgians (53.2%) do not consider contactless card payments for small amounts under 25 euros to be secure. The vast majority lack confidence in the underlying security system and attribute this to a lack of information about safety. When it comes to payment with a smartphone, 44.8% also consider it unsafe. Here, too, 63.5% attribute their concerns to a lack of information.

However, contactless payments with a card or smartphone are just as secure as traditional card payments. They use the same secure network as regular card payments. Moreover, a PIN code is required for payments over 25 euros. Even in countries where contactless payment has become the new norm, security or widespread fraud is not a major issue.

Karel Van Eetvelt, CEO of Febelfin, responds: "It is clear that there is still a lot of work to be done to change the perception and behavior of Belgian consumers. While we sometimes find it embarrassing to use our card for small amounts, in other countries, this embarrassment is more associated with paying in cash. Cash also has a cost, which many Belgians do not consider enough. Lack of information is at the root of this, and that is where Febelfin wants to make a difference. By providing the necessary information, we aim to guide and educate consumers in a society that is becoming increasingly digital, not only in the financial sector but in every aspect of our lives. In this way, we want to try to get as many people as possible on board with the digital trend."

Febelfin presents Digital Payment Day

As part of Febelfin's mission to enhance the financial literacy of Belgians, Febelfin is launching the very first Digital Payment Day. Between now and Saturday, May 11th, Febelfin, in collaboration with partners in the payment industry and trade federations, aims to persuade as many merchants as possible to offer digital payment options and encourage consumers to make their purchases using cards or smartphones.

Febelfin is kicking off the campaign today with the slogan "Pay digitally. It's the new normal," in which cash campaigns against itself.

The entire sector is joining in the effort

Digital Payment Day is an initiative by Febelfin, in collaboration with partners from the payment sector and trade federations: Bancontact Payconiq Company, Mastercard, Visa, Worldline, CCV, Unizo, UCM, Comeos, NSZ, SDZ, and Europabank.

Nathalie Vandepeute, CEO of Bancontact Payconiq Company, states: "Bancontact Payconiq Company is particularly pleased to offer solutions that make digital payments secure and easy for both consumers and merchants. With the new Payconiq by Bancontact app, consumers can make digital payments everywhere they see the Bancontact or Payconiq logo, both in stores and online. Digital payments can also be made with the familiar Bancontact card, whether contactless or not. Merchants and businesses have the choice to offer Payconiq and/or Bancontact as payment methods to their customers. Payconiq is an affordable digital payment method because there are no fixed costs, additional investments, or subscription fees for the merchant. Bancontact accounts for more than 1.37 billion transactions per year in Belgium. We are proud to deliver the favorite digital payment methods of Belgians, in stores and online."

Henri Dewaerheijd, Country Manager of Belux Mastercard, says: "Our studies show that electronic payment is increasingly preferred by consumers. Therefore, in 2019, it is no longer in line with a customer experience strategy to offer only cash as a payment method. Merchants have everything to gain by promoting electronic payments: improved checkout flow, better income control, increased security, and simplified accounting."

Jean-Marie de Crayencour, Country Manager for Belgium and Luxembourg at Visa, adds: "We are delighted to participate in this campaign alongside various players in the Belgian ecosystem. Whether for merchants or consumers, digital payments are synonymous with convenience, security, and ease of shopping. That is why Visa invests in the most innovative payment technologies and creates collaborations. This allows us to offer users and sellers secure and protected payment methods."

Danny Van Assche, Managing Director of Unizo, notes: "Consumers increasingly demand digital payments, and as an entrepreneur, you must respond to that. Digital payments have undergone many developments in recent years, leading to easier and cheaper payment methods. So, it's time to fully embrace digital payments."

Arnaud Deplae, Secretary-General of UCM, emphasizes: "The Digital Payment Day is not just a temporary campaign but aims to bring about a long-term behavioral change. Practical, simple, safe, and guaranteed, digital payments should be encouraged as a win-win situation for merchants, with limited costs."

Hans Cardyn, Director of Communication at Comeos, states: "As the federation for trade and services, Comeos has a significant lever when it comes to the introduction and acceptance of payment methods. By supporting Digital Payment Day, merchants promote digital payments to offer safe, simple, and intuitive payment solutions in collaboration with all partners."

Vincent Roland, CEO of Worldline Belgium, says: "We are moving towards a society where consumers want to pay with their bank card or smartphone everywhere and at any time. Worldline aims to enable merchants to meet their customers' expectations."

Christine Mattheeuws, Chairwoman of NSZ, mentions: "The reason why merchants have not yet fully embraced the digital trend is that they still have too many questions about the various payment methods available and the associated costs. Because this large-scale initiative provides entrepreneurs with guidance on digital payments, NSZ is lending its support. Small business owners have long been asking for transparency, and with this initiative, we are taking a step in the right direction."

Dimitri Beck, CEO of CCV Belgium, states: "History has taught us that progress in electronic payments is only possible when banks, trade federations, and payment service providers work together. Consumers expect us to provide direction together because they carry less cash. An additional motivation comes from major international players like Google and Facebook, who are eager to launch their payment solutions in Belgium. They are simultaneously a partner, a competitor, and a mirror when it comes to payment innovations."

Daniel Cauwel, President of SDZ, mentions: "SDZ supports digital payment, which is an integral part of commerce and new consumption habits. Digital payment guarantees a fast, secure, and controlled payment system. This information day will encourage hesitant merchants to embrace the digital path."

Tom Verlinde, Product Manager at Europabank, adds: "Europabank is a 100% Belgian bank that, in addition to traditional banking activities, has been involved in transaction processing for bank and credit cards for more than 25 years, both in physical stores and in e-commerce. As a partner of the Digital Payment Day, Europabank underscores the importance of secure, fast, and easy payments, as well as supporting merchants in finding the right digital payment solution.".”

About the research

Online research conducted by the research agency iVOX on behalf of Febelfin between April 8, 2019, and April 12, 2019, among 1000 Belgians, representative in terms of language, gender, age, and education. The maximum margin of error for 1000 Belgians is 3.02%.