An 'app-etite' for banking

3 March 2021 - 14 min Reading time

How we bank today

What does the future of the financial sector look like in the long term? That was the question asked to a group of students from the Solvay Brussels School of Economics & Management, the University of Ghent, and the KU Leuven 10 years ago.

Together with the consulting firm HazelHeartwood, the students conducted extensive fieldwork, carried out market analyses, launched online surveys, and conducted various personal interviews. They then compiled their vision into a report explaining how they saw the banking model evolving in the coming years.

Their vision for the year 2020 was:

- a bank that turns the customer into the banker

- a cooperative bank that makes its customers shareholders

- an institution without branches or ATMs in a cashless society

- a bank that primarily operates via the internet and social media

- mainly a facilitator, focusing on trade and information exchange among its customers

- an institution that proactively informs and educates its customers in financial matters, especially through electronic platforms

Meanwhile, we have moved beyond 2020, and it's worth taking a look at how their predictions align with today's reality. How do we bank today, and what about our "app-etite" for banking?

A bank that turns the customer into the banker

Digital banking, where the customer chooses where and when to bank, has seen tremendous growth in recent years. The numbers related to mobile and internet banking subscriptions continue to rise, and new communication channels such as video calls and chat functions are becoming increasingly popular.

Furthermore, the COVID-19 pandemic has pushed even more people to embrace digital banking. The "app-etite" for digital banking is indeed real, as evidenced by the following figures.

App and PC are the most popular channels for banking

According to a recent iVOX study, the most popular channels for using banking services are PC (internet banking) and mobile apps (mobile banking):

Ivox study conducted with 1000 Belgians, commissioned by Febelfin, carried out between November 25th and November 30th, 2020 (representative in terms of gender, language, age, and education level. Maximum margin of error for 1000 Belgians is 3.02%).

- 90% of Belgians say they use banking services via PC at some point. PC banking is also well-established among seniors (91%), while younger individuals tend to use mobile banking more frequently.

- 7 out of 10 Belgians (71%) report using banking services via mobile apps. Among young people, this figure rises to almost 9 out of 10.

- Both channels are often used in combination with each other.

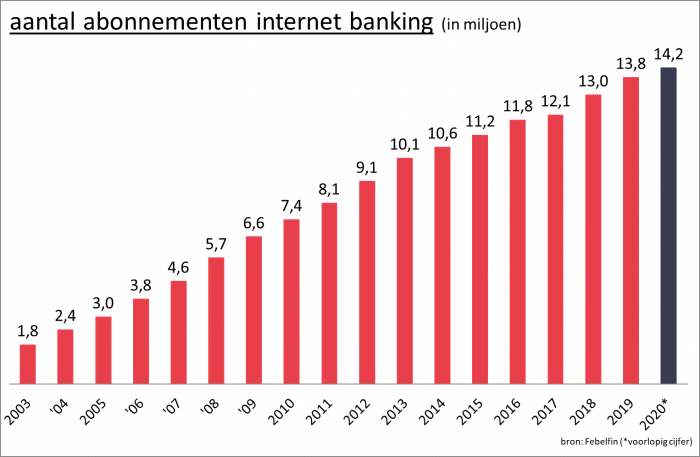

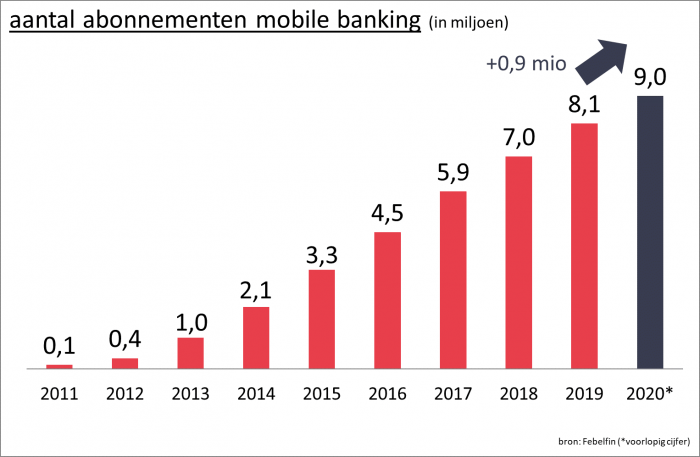

- In the past 5 years, the number of online banking subscriptions has grown by 5% annually, despite already having more than 11 million subscriptions in 2015. The number of mobile banking subscriptions has increased by over 20% per year over the same period. Number of online banking subscriptions at the end of 2020: 14.2 million (an increase of 3.1% compared to the end of 2019). Number of mobile banking subscriptions at the end of 2020: 9 million (an increase of 11% compared to the end of 2019).

- Mobile banking, in particular, continues to grow. In the last 5 years, an average of more than 1 million mobile banking subscriptions has been added annually. There are nearly three times as many mobile banking subscriptions compared to the end of 2015.

The use of PC and mobile banking is also on the rise: 44% of Belgians perform transactions with their bank app several times a week. This not only provides Belgians with a better overview of their financial situation but also reduces the need for trips to the bank, benefiting our ecological footprint.

Top 3 services via app or PC banking

- When asked about the top 3 services they use most through the app or PC banking

- conducting payments is by far the most commonly mentioned (85%). Among seniors, this figure is 60%.

- Checking balances and transactions (69%).

- Executing transfers between their own accounts (44%) is also frequently mentioned.

Further growth in video calls and chat

- New technology and a wider choice of communication channels have also led to new, easier, and faster interactions between customers and their banks. People now have more access to a range of banking services, whether at home, on the go, or at work.

- 28% of Belgians occasionally use video calls to consult banking services.

- Belgian youth, in particular, use video calls to access banking services (39%). However, 18% of those aged 55 and older have also used this method.

- Live chat is also gaining popularity, with 33% of Belgians reporting occasional use. Here, too, it is primarily younger individuals who make extensive use of this channel (46%), but it is not unfamiliar to 1 in 5 seniors.

COVID-19 accelerated digital adoption

- There is an ongoing evolution in how we manage our financial affairs. The trend of customers increasingly using bank apps continues at a rapid pace. The COVID-19 pandemic has further accelerated this existing trend.

- More than 1 in 10 Belgians (13%) report using digital banking more frequently since the pandemic.

Physical visits to bank branches are decreasing: Belgians prefer online interaction

Due to increasing online options for contact between customers and banks, the number of physical visits to bank branches is steadily declining.

Physical appointments at bank branches are very limited

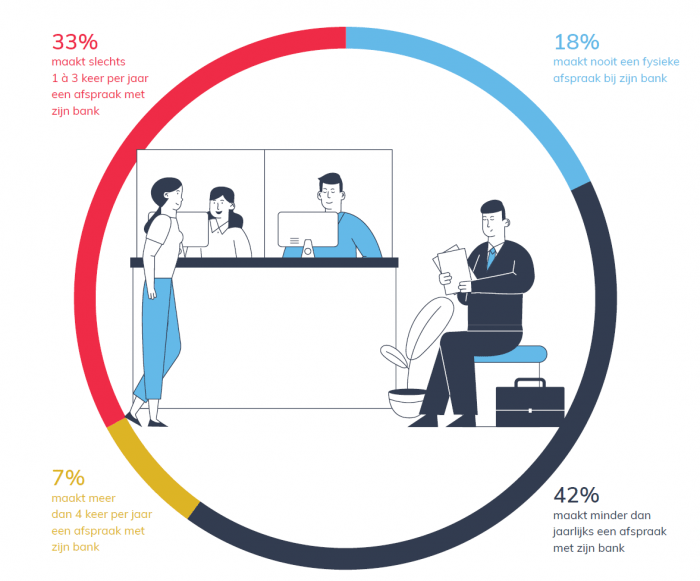

- A staggering 60% of Belgians never or less than once a year make a physical appointment with their bank. 33% of Belgians make 1 to 3 appointments with their bank per year.

- Even among seniors, the number of visits to the bank is limited: half of them never (16%) or less than once a year (33%) visit a bank branch, and 45% go 1 to 3 times a year.

- These figures indicate that more than 9 out of 10 Belgians visit a bank branch only to a limited extent.

Services that warrant a physical appointment

The study reveals that the popular services for which people occasionally make a physical appointment at their bank branch include:

- Seeking advice on their personal financial situation(29%)

- Monitoring and receiving advice on investments (26%)

- Applying for and managing loans (24%)

The advisory function of the bank plays a significant role here. For the above services, individuals prefer face-to-face interaction (either physical or virtual) with a bank employee. The human aspect is crucial.

Half of Belgians are open to more online interaction

Personal contact can also occur remotely, as we have seen more than ever during the COVID-19 pandemic. Nearly half of Belgians (48%) say that contact with their bank can comfortably occur more often online. This percentage rises to 60% among young people, but 4 out of 10 seniors also believe that contact could happen more frequently online.

What about transfers?

The way of doing transfers also follows the same digital trend. In 2008, 21% of transfers were still done through bank ATMs (self-service machines), while in 2019, this had decreased to only 5% of transfers. Paper transfers have also decreased by about 88% over a 15-year period. The same trend is observed among seniors. The Ivox study shows that only 4.2% of those aged 55 and older still go to the bank branch to make transfers.

How is this trend translated into practice?

In 2010, the students predicted that by 2020, we would have evolved into a banking landscape without branches or ATMs in a cashless society. However, this did not happen, and it is also not the ambition of the financial sector.

Fewer bank branches but still many compared to other European countries

Today's bank branch is both physical and virtual. Because Belgian customers are increasingly banking digitally themselves, they visit a bank branch less often than before. Even the reasons for which they used to visit the bank branch can now be handled online: adjusting credit limits, ordering debit cards, reporting lost credit cards, and more.

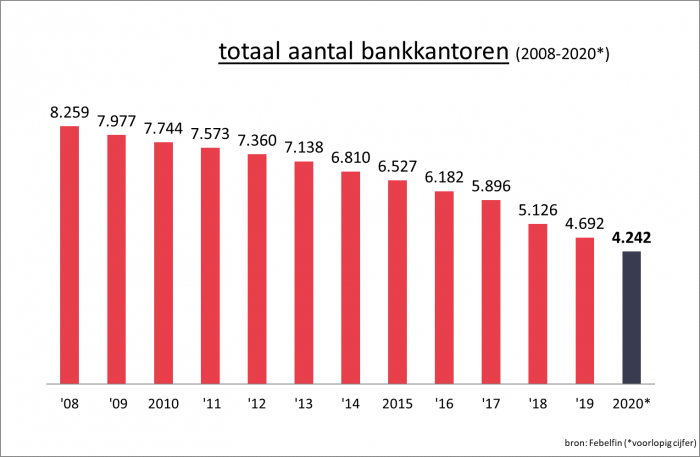

The banks closely monitor this societal trend and align their branch offerings accordingly. This does not mean that Belgian consumers can no longer go to a physical branch; as of the end of 2020, Belgium still had 4,242 bank branches. This represented a decrease of 9.6% compared to the previous year.

The reduction of the current branch network is an evolution that has been underway for several years and follows today's societal trend. This is a trend also observed in other European countries. Belgium still has one of the densest branch networks in all of Europe.

What about cash withdrawals? Use of cash is declining significantly

In 2020, digital payments experienced a further breakthrough, partly due to the COVID-19 pandemic. Paying with cards or smartphones is a very secure and hygienic way to make purchases, especially when done contactless. Belgians adjusted their payment behavior accordingly and seem to be maintaining this new digital habit.

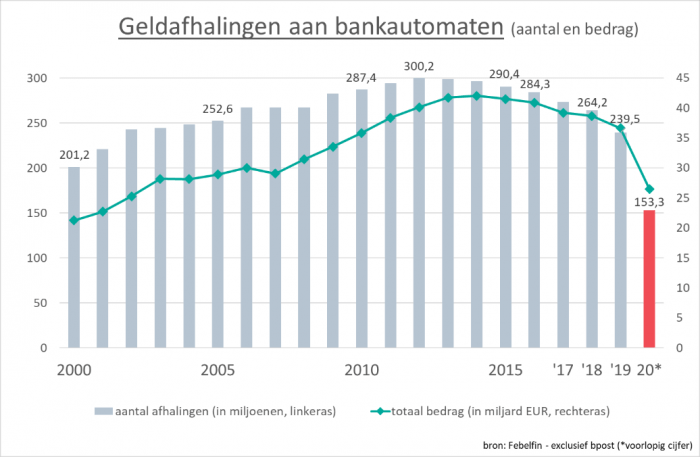

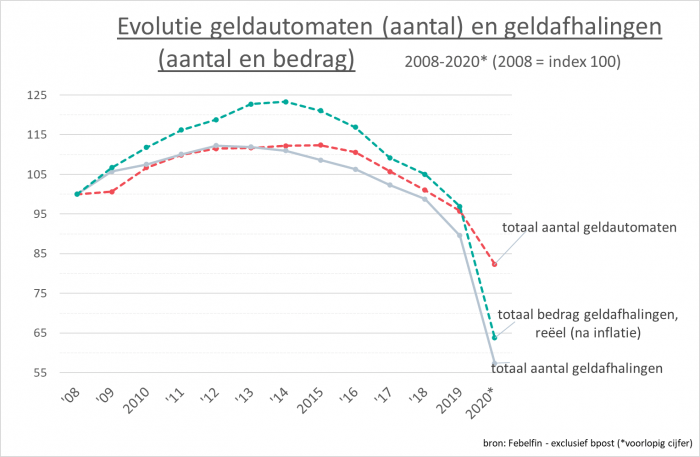

In 2020, there was a significant decline in cash withdrawals at ATMs. The number of cash withdrawals in 2020 decreased by more than a third (36%) compared to the previous year, and the amount withdrawn decreased by 28%. If we compare this to 2012, the number of cash withdrawals has approximately halved. The trend of fewer cash withdrawals has been ongoing for some time, but it now seems to be accelerating. The government also has the ambition to require traders and liberal professionals to offer a digital payment method alongside cash in the future.

Changing customer behavior translates into fewer ATMs

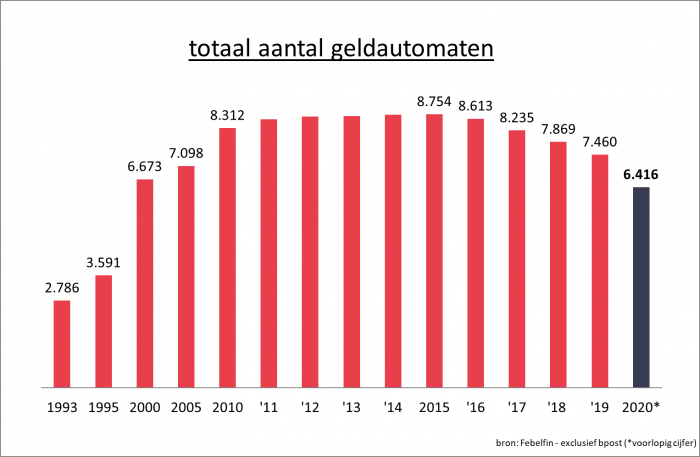

Banks regularly evaluate how they interact with customers and how they can best serve them in line with their individual commercial policies. This includes taking into account technological evolution and changing customer behavior. We observe that customers are increasingly banking digitally and making electronic payments. Since 2015, we have seen a declining trend in the number of cash withdrawals.

Nevertheless, the demand for cash still exists, and access to cash is an important goal of the financial sector. In Belgium, the network of ATMs is still significant. In 2020, Belgians could access 6,416 bank ATMs, which represented a 14% decrease compared to the previous year. Currently, two initiatives, Batopin and Jofico, are being rolled out to ensure continued access to ATMs for everyone.

Conclusion

The "app-etite" for digital banking is more present than ever, as evidenced by the evolution toward more digital payments and the results of the Ivox study. People are making physical appointments at bank branches less frequently, and there is a desire to further expand online service delivery. This changing customer behavior is observed in all age groups, from young people to seniors. However, the financial sector is aware of the importance of digital inclusion and the need for assistance and guidance for those who have not yet embraced the digital world. Several initiatives have already been launched, such as the module 123.digit.be, which provides assistance with mobile banking, and "J'adopte la banque digitale," which organizes sessions and provides help with the transition to digital banking.

Digitalization is an irreversible societal trend, and as a financial sector, we are ready to provide the necessary support and guidance to get everyone on board the digital train. In the future, we will continue to keep a close eye on developments and work on further initiatives in collaboration with local authorities, consumer organizations, seniors' organizations, and welfare organizations.

The banking sector is fully committed to a 'multichannel' approach tailored to customer preferences. Both bank branches, ATMs, contact centers, video calls, PC, and mobile banking all have their place.